What is volatility?

Volatility is an important measure of risk. How safe is my investment? What does volatility tell us exactly? What is the VIX and what has Fear and Greed to do with it?

As of now we looked into the "Buy and Hold" strategy and the problem of the 'Lost Decade" and how immensely powerful "DCA - Dollar Cost Averaging" is. We defined our first investment strategy and I promised that we will test it in more details, but before we can do this we need to dive deep into volatility. Actually not a real deep dive - but deep enough that you know the most important aspects of volatility. Please be warned you will see a mathematical formula in this post. But do not worry it is just for show.

In plain English - volatility measures how much the price fluctuates on a daily or annual basis. That's it!

Just look at the price chart!

Look at these two price charts and tell me which one has a higher volatility. A or B? Picture A is our good old friend the SPY ETF (all the top 500 US companies which are in the S&P500 index).

Picture B is an ETF called SOXL. Now SOXL is an interesting one. It's quite a handful! Created in 2010 it tries to track the performance of The Philadelphia Semiconductor Index (SOX) multiplied by 3. When the SOX goes up by 1% the SOXL goes up by 3% and if the SOX goes down by 1% the SOXL goes down by 3%. What? Is that legal and how is that even possible?

First of all - yes it is legal and it is done with "leverage". A simple explanation of leverage is when you invest $100 into SOXL the ETF manager will borrow another $200 to invest a total of $300 on your behalf. Leverage amplifies both gains and losses—SOXL’s 3x leverage means it reacts three times more to market movements than SPY. Therefore you get 3x the excitement. Like the triple looping at the roller coaster.

Back to our question. Which one has a higher volatility?

SPY gave us a 24% performance for the last 12 month and SOXL almost 28%. But holy cow! For that additional 4% more performance we had to change our underwear at least twice in the last 12 month when the SOXL made a nose dive in April and July. The simple answer is B!!

Yes B has the higher volatility - for sure. We can calculate the annual volatility by using the daily price data from the chart. When we do that we get 88% for SOXL and for SPY a 12% annual volatility number.

For all the nerdy geeks out there! Here is the formula for the annual volatility.

$$ \sigma_{\text{annual}} = \sqrt{\frac{1}{N} \sum_{i=1}^{N} (R_i - \mu)^2} \times \sqrt{252} $$But trust me! In the age of AI and tools like ChatGPT there is no need to get into technical territory. We just need to get the big picture and understand that we can calculate the volatility to measure what the price chart tells us on an intuitive level!

Now we know that SPY has a 12% and SOXL a 88% volatility. Great! But how useful is that really? What does it tell us?

What does volatility really tell us?

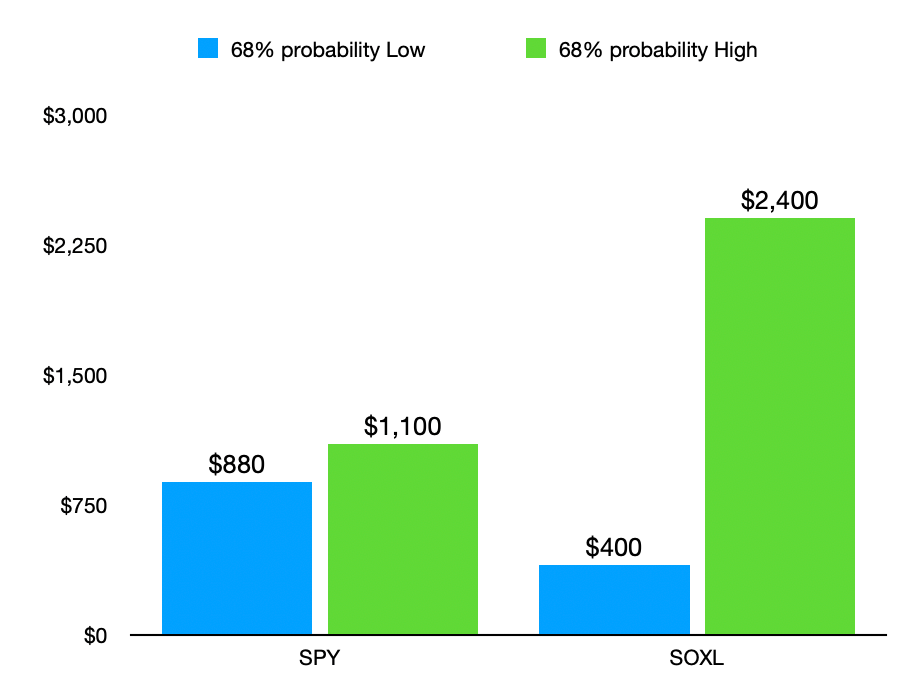

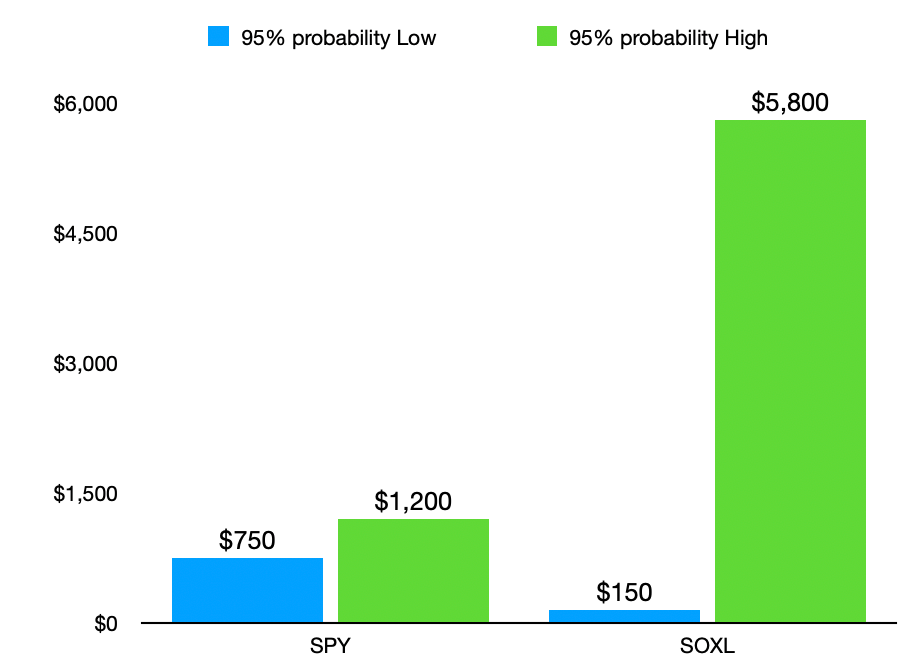

Let's assume we invest $1,000 in SPY and $1,000 in SOXL today. The annual volatility of 12% for SPY and 88% for SOXL tells us ...

In one year time and with a 68% probability (the 68% is a statistical standard and called a 1 standard deviation in the land of statistical nerds) the SPY can be between $880 and $1,100 and the SOXL between $400 and $2,400.

In one year time and with a 95% probability (thats called 2 standard deviations) the SPY can be between $750 and $1,200 and the SOXL between $150 and $5,800.

Hold on!! I can lose almost everything with a 88% annual volatility SOXL?? No way!

Yes. We can even calculate that there is a roughly 2.5% chance that you could lose a significant portion (e.g., 90% or more) of your investment within one year.

This is highly relevant. With the volatility number we can calculate the value range any investment can move in a year.

Before you take a sip! Be warned. 88% annual volatility is a lot.

I do not want to beat up the SOXL ETF, after all they have almost $12bn assets under management. That means a lot of people have put their money into SOXL. Not sure if all of them know what you do now - that SOXL has a 88% vol.

You are a professional now. You can call it vol instead of volatility.

Can anyone predict the future?

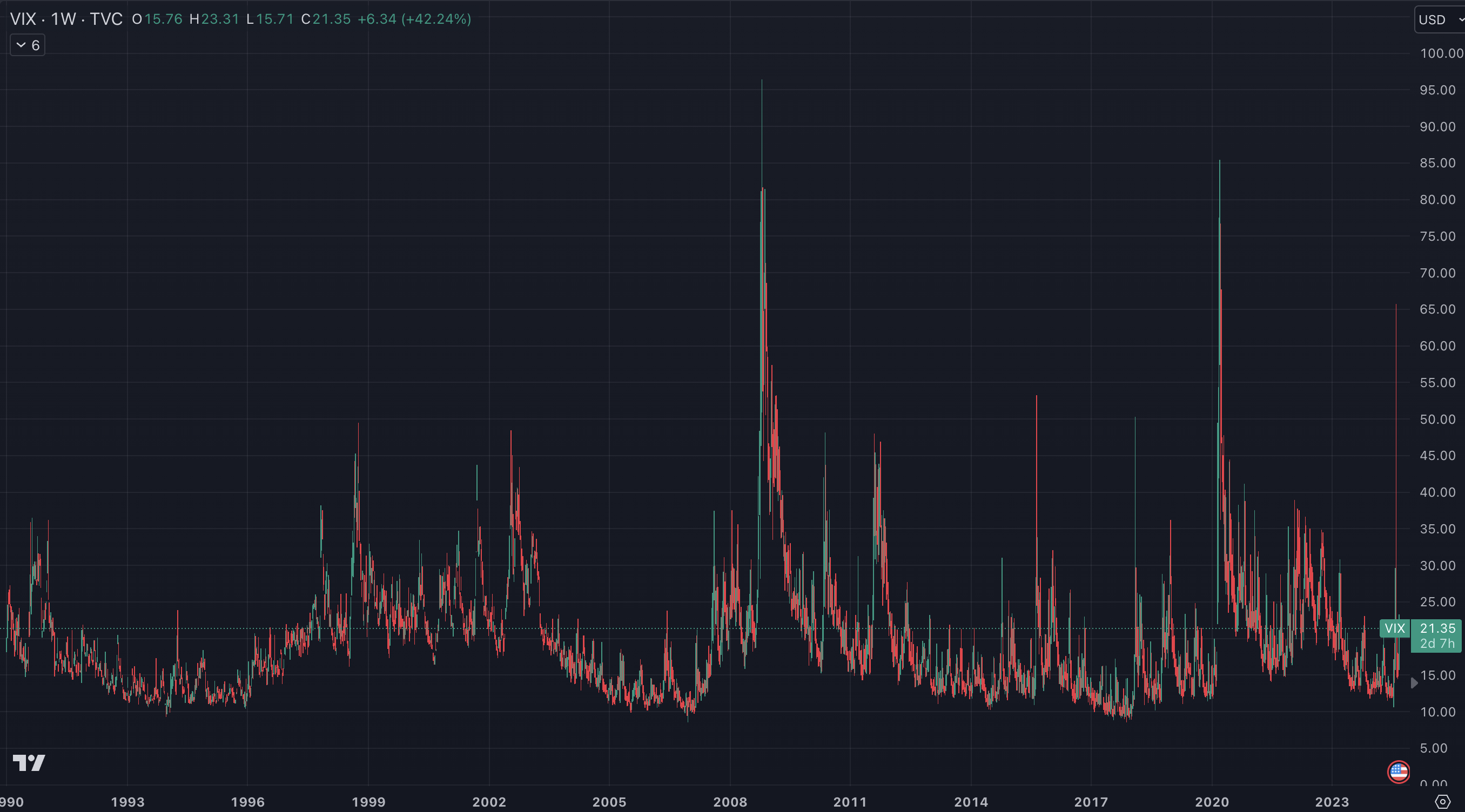

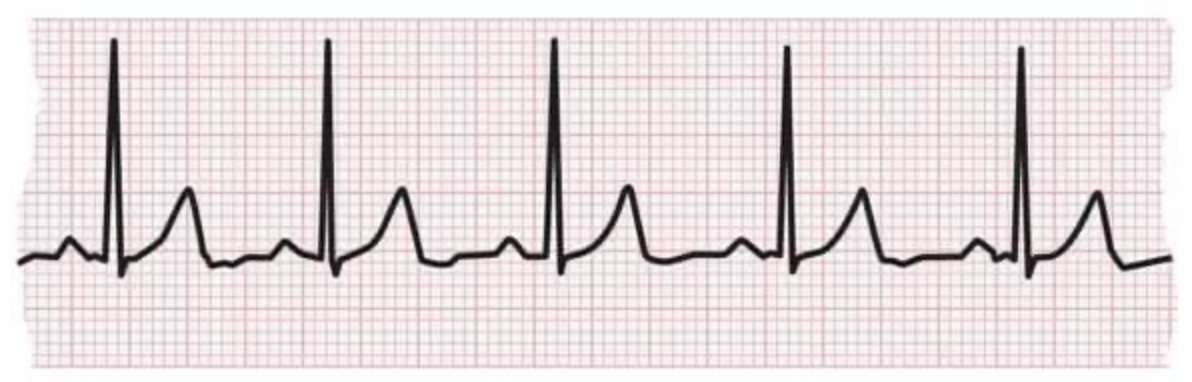

Have you ever heard about the VIX? It stands for Volatility Index! Here is a weekly price chart for the VIX since the 90s. What we can see is that it goes up and down.

The VIX looks almost like EKG cart showing the heart rate.

The VIX measures the market’s expectation of volatility over the next 30 days. Uh! Interesting. It is not backward looking. It is truly the best estimate for what the future might bring. It is often referred to as the “fear gauge” because it tends to rise when investors anticipate significant market fluctuations or uncertainty.

We have not talked about options yet, but the VIX is calculated from the prices of options on the S&P 500 index, with higher option prices indicating higher expected volatility. A high VIX suggests that the market expects large price swings, while a low VIX indicates calm, stable market conditions.

Nobody can predict the future of course, but looking at the VIX will give you the best judgement from all the players in the casino, uhm hmm sorry ... I mean all investors and market participants what they think about the immediate future.

Any increase in uncertainty, economical or political will be reflected in a higher VIX. We all remember what happened early 2020 when the news about COVID-19 hit and as you can see immediately the VIX increased from around 16 to over 80 in less than 4 weeks.

You can check the current VIX for free at Yahoo.

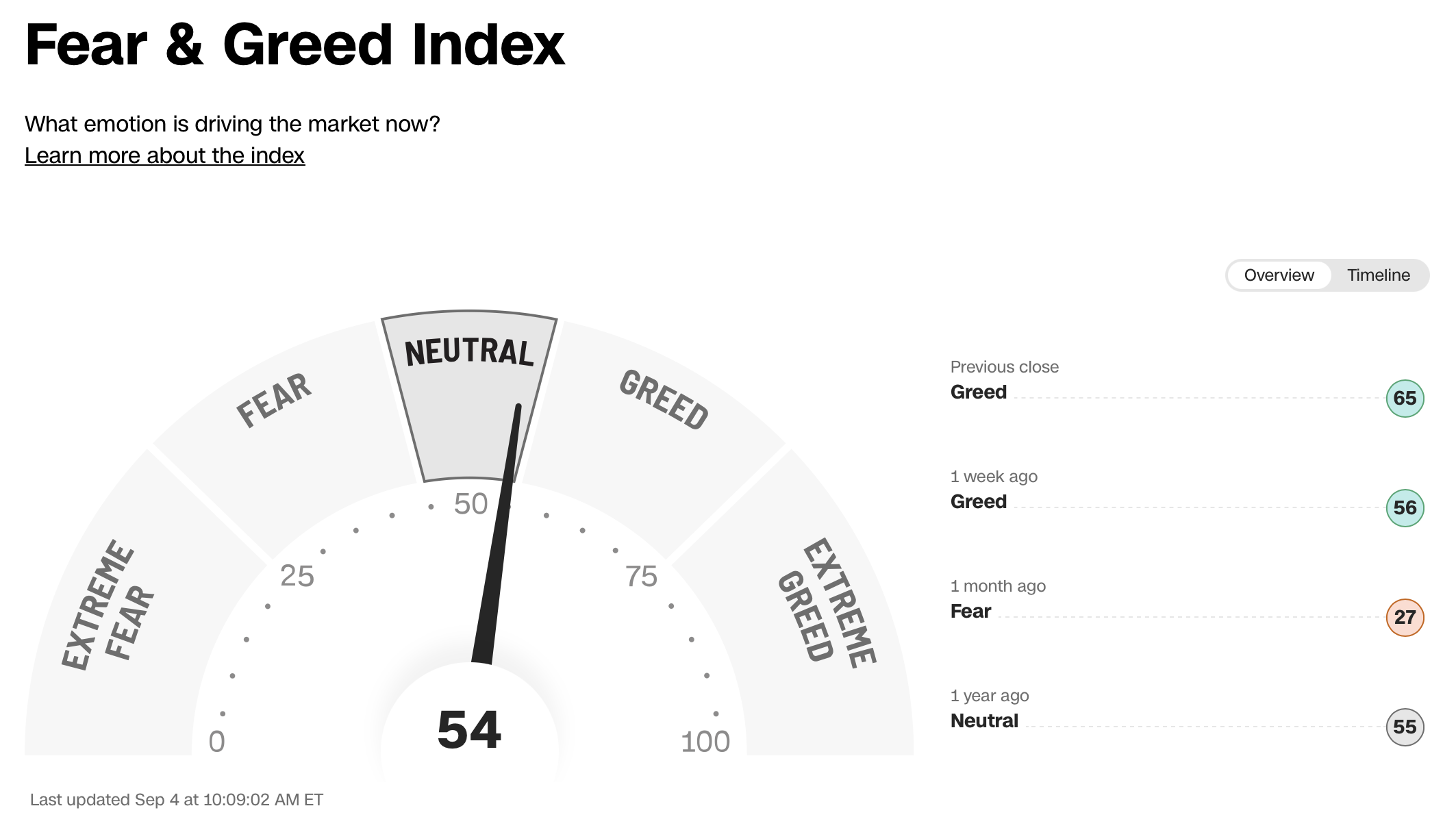

You can also look at the CNN site where you can see the Fear & Greed Index. This is not measuring volatility alone. It is more a sentiment indicator which shows in what kind of state the overall market is. In order to calculate the Fear & Greed Index - volatility is one of seven input factors. This can be useful to just get an overall picture of the markets.

Why do we care about volatility?

Is your head spinning? Let's take a deep breath and think about why do we care about volatility?

It is very simple. Behind all that technical aspects of volatility there is only one important question we care about. How safe are my investments?

If I invest my hard earned money into XYZ ETF or XYZ stock how much could I potentially lose? Do I need to prepare new underwear because a financial hurricane could create a mess in my account or can we expect easy sailing with calm seas and Virgin Piña Coladas?

The 30/60 volatility rule of thumb!

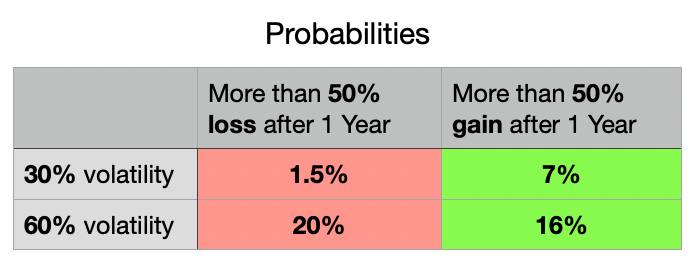

Let's create a volatility rule of thumb to be remembered! The benefit of understanding volatility is that we can estimate the probability of gaining or losing more than 50% in a year.

With a 30% annual volatility there is a 1.5% risk that we could loose more than 50% and a 7% chance we can make more than 50% after one year.

With a 60% annual volatility there is a 20% risk that we could loose more than 50% and a 16% chance we can make more than 50% after one year.

Boom! Now you know! Thats it!

The higher the volatility the higher the risk and chances! But how much risk do you have to take for my investment goal? We will get there.

Hold on! I almost forgot - you are getting another promotion! You are now a Baby Algorithmic Portfolio & Risk Managers

Congratulations!

Please share this with a friend you think might benefit from this. Place a comment if you want us to write about a specific topic or want us to research a particular question. After all you are all friends and family! Literally!