Welcome to the New Age of Rule Based Investing: You, Python, and ChatGPT!

With tools like ChatGPT, even non-programmers can learn to use Python to become confident, data-driven investors.

Guess what? We’re not programmers. Well, at least we didn’t start that way. But with the recent surge of tools like ChatGPT, we’re closer to programming than we ever imagined. Yes, you can program, and in this post, We’ll show you how Python and ChatGPT can transform you into a confident, data-driven investor.

If you’re interested in making investment decisions based on facts and rules instead of opinions, learning Python might be the best next step. It’s not just a programming language; it’s a powerful tool that lets you analyze data, automate tasks, and develop strategies—all without an extensive coding background. And thanks to ChatGPT, learning Python has never been easier.

Why Python? Simple, Powerful, and Perfect for Investors and Traders

One of Python’s greatest strengths is its readability. Designed to be intuitive and straightforward, Python helps you focus on your investment questions rather than coding complexity. Say you want to analyze a decade of stock data to spot trends across companies—Python allows you to do that with just a few lines of code.

For example, you could calculate annual growth rates or identify high-return quarters with ease. Python’s syntax is close to plain English, so you can get valuable insights without getting lost in technical details. It reads almost like a book.

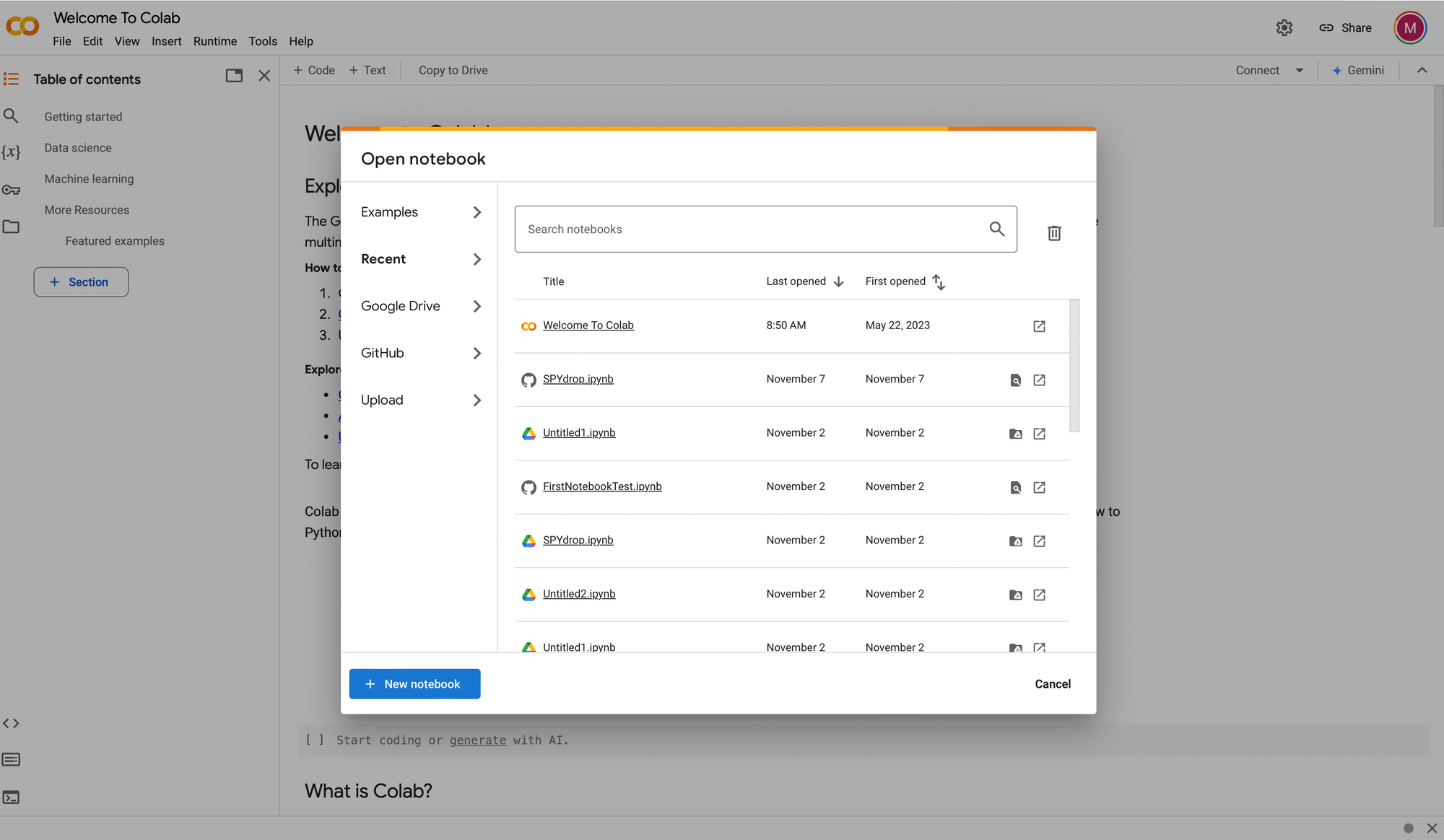

To get hands-on, we’ll use Google Colab, a free tool that lets you write and run Python code in the cloud. In order to run Colab you need a Google account. You can check by clicking here to open Google Colab. If you have an account and are logged in you will see something like this:

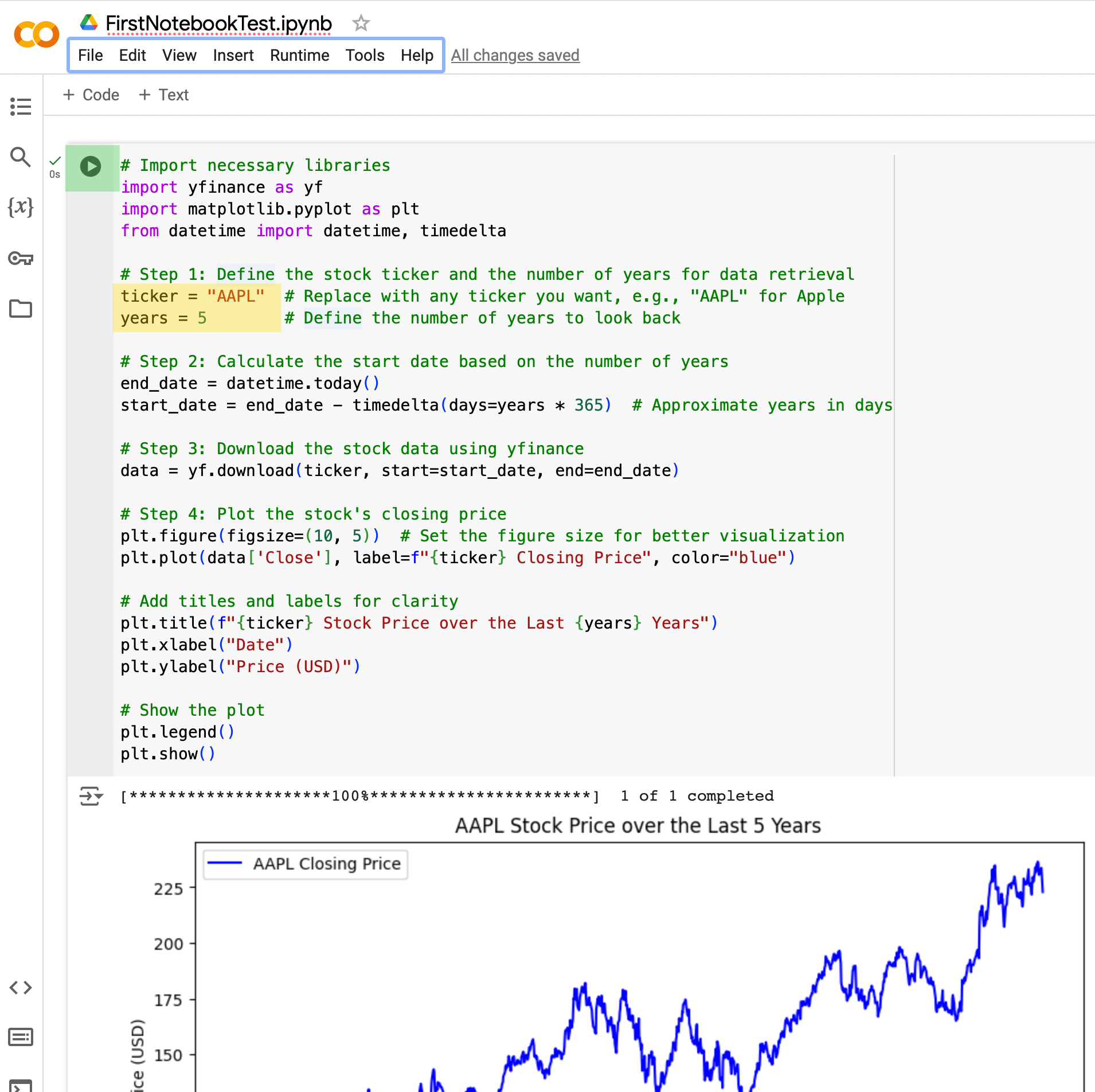

Now you can close this browser window and click here - My First Python code in Colab - you should see the following code and chart:

Now, I want you to change the ticker from 'AAPL' to 'TSLA' and the years from 5 to 10. You find this in Step 1 in the code window (yellow box in the picture). Once you have done that, click on the play button (green box in the picture) located in the top left area of the code window .

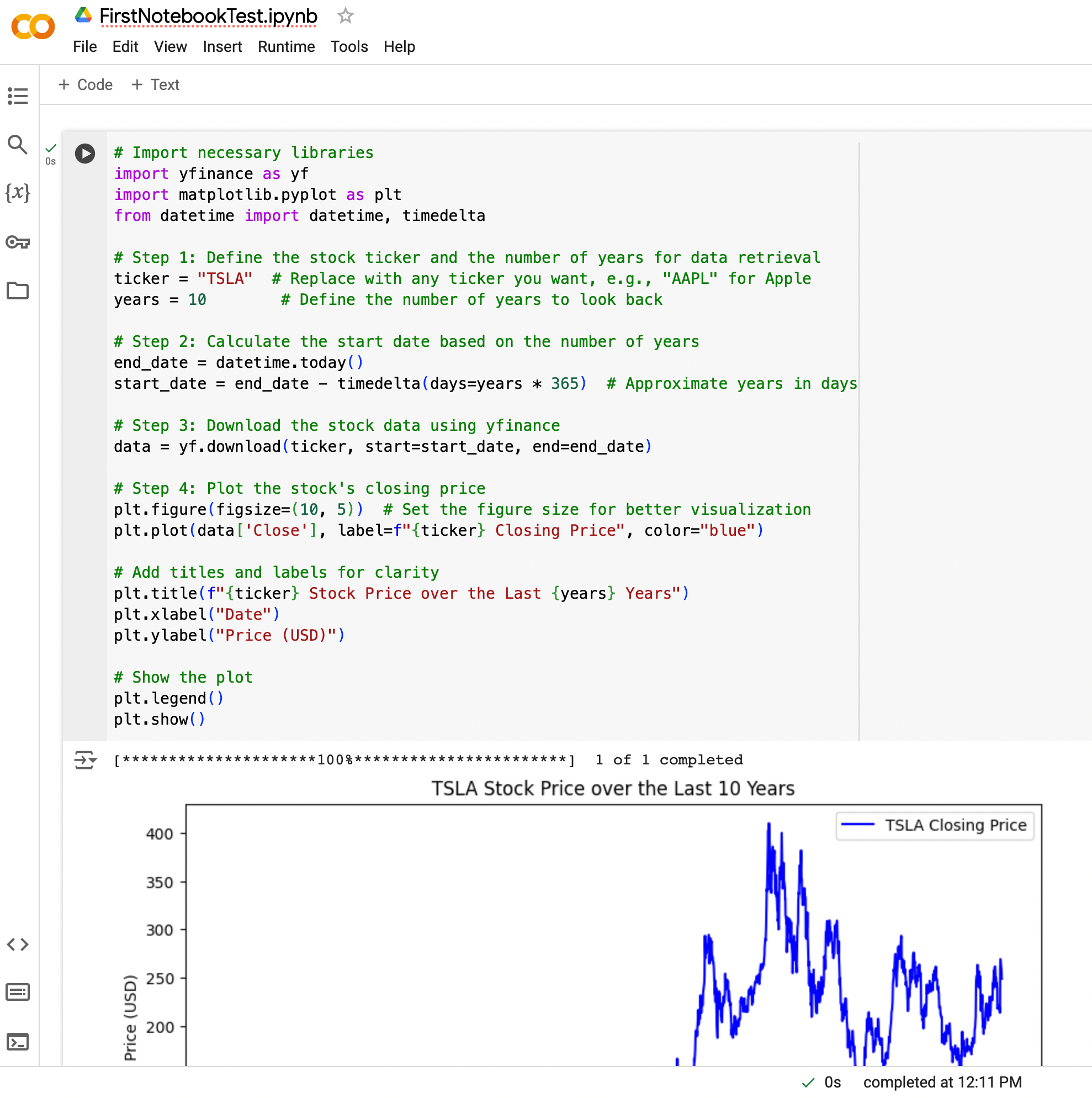

After clicking the play button you should see a new plot with a 10 year price chart for Tesla.

That was easy! Right? You just build your own personal investment research lab! Excited?

Level Up: Creating Your First Analysis

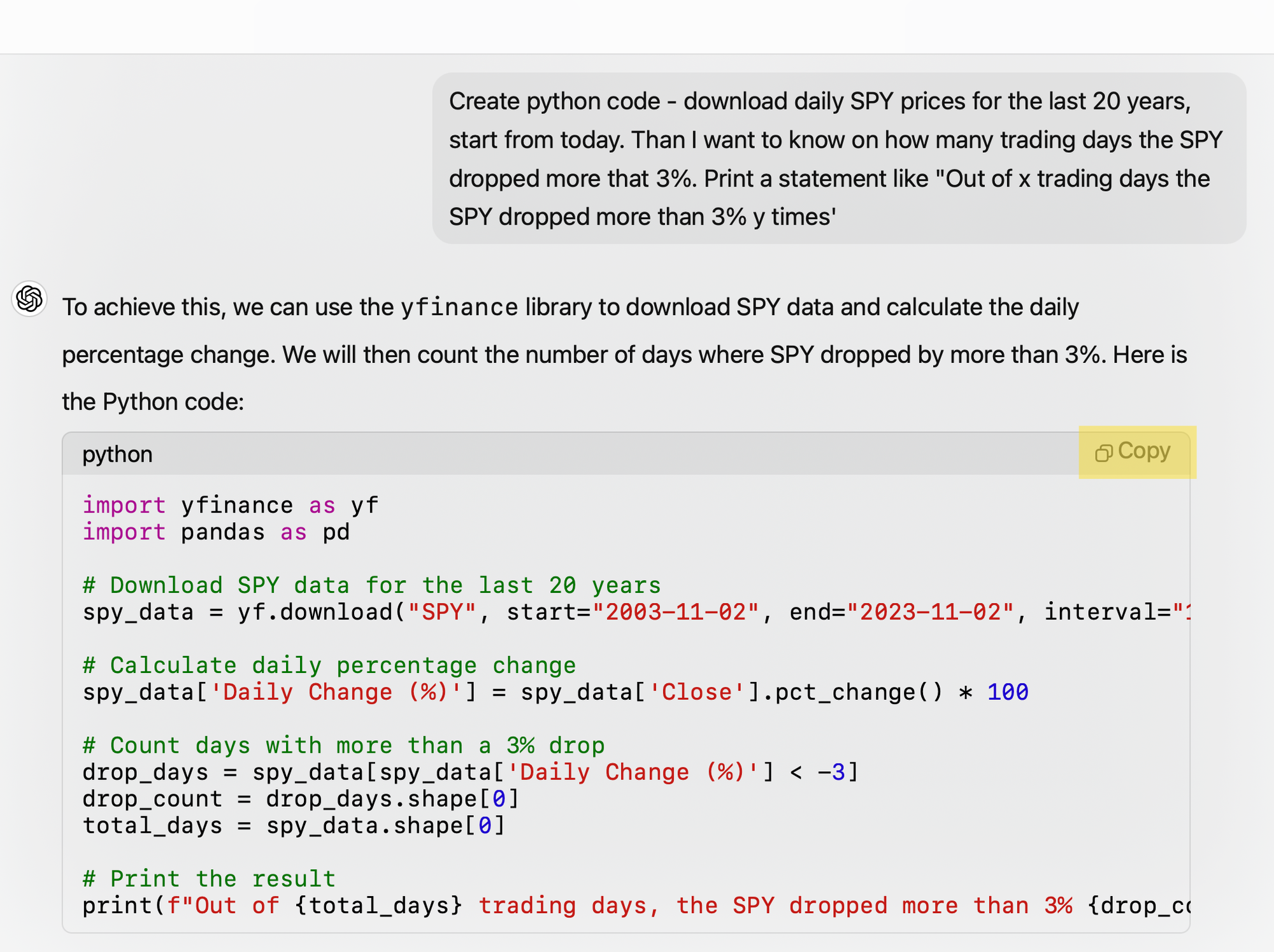

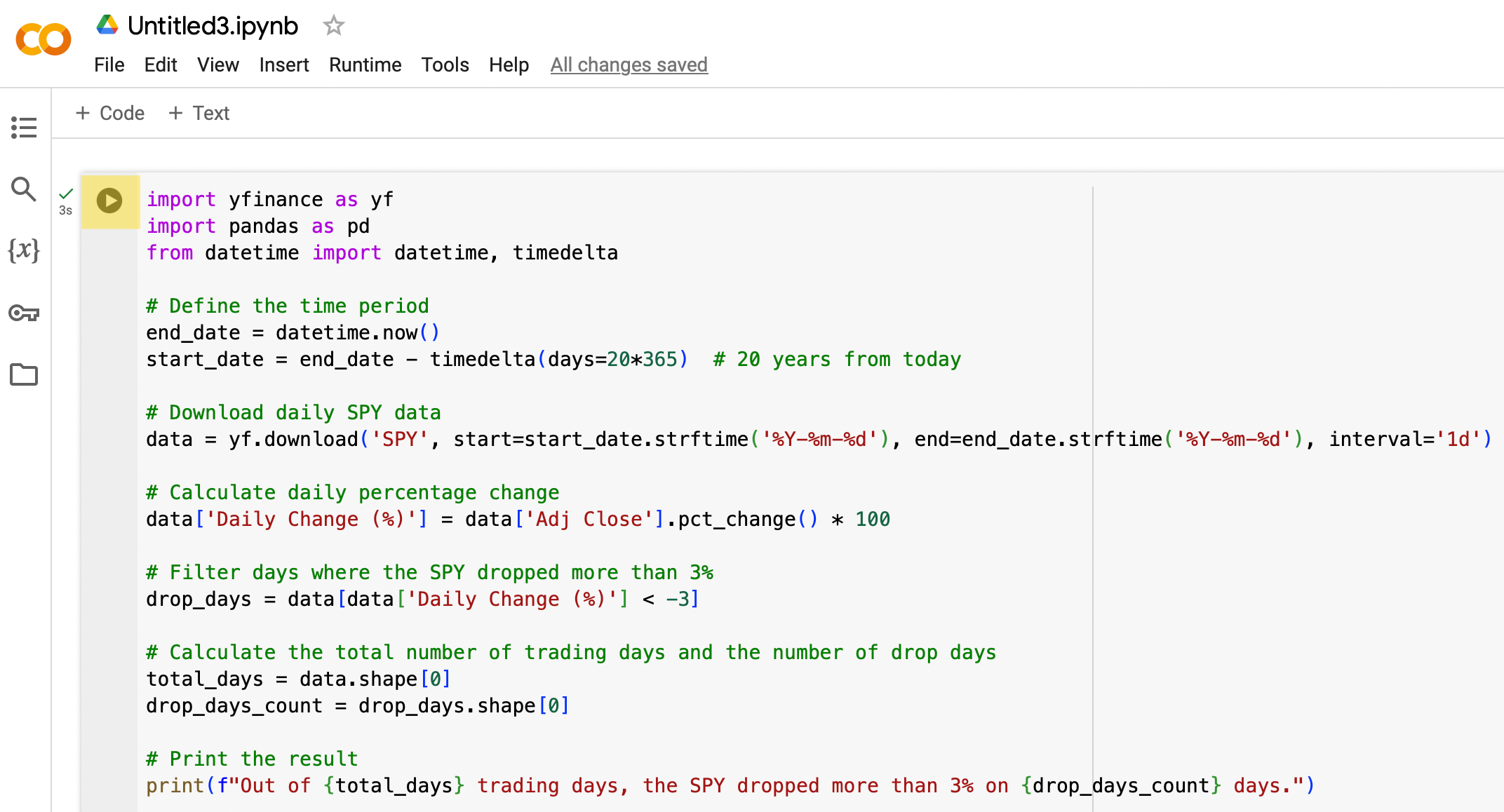

Copy these instructions and paste it into ChatGPT:

Create python code - download daily SPY prices for the last 20 years, start from today. Than I want to know on how many trading days the SPY dropped more that 3%. Print a statement like "Out of x trading days the SPY dropped more than 3% y times'

Then copy the code you got from ChatGPT. Simply use the copy button (yellow box) on the top right of the code window .

It is possible that you get a different code than the one above, because there are always different ways to implement this request. As you know ChatGPT will not always be correct. But this example should work because it is quite simple.

Go to your browser and start a new notebook in Colab. If you still have a notebook open then go to File and select 'New Notebook in Drive". You should now have a new empty notebook like this:

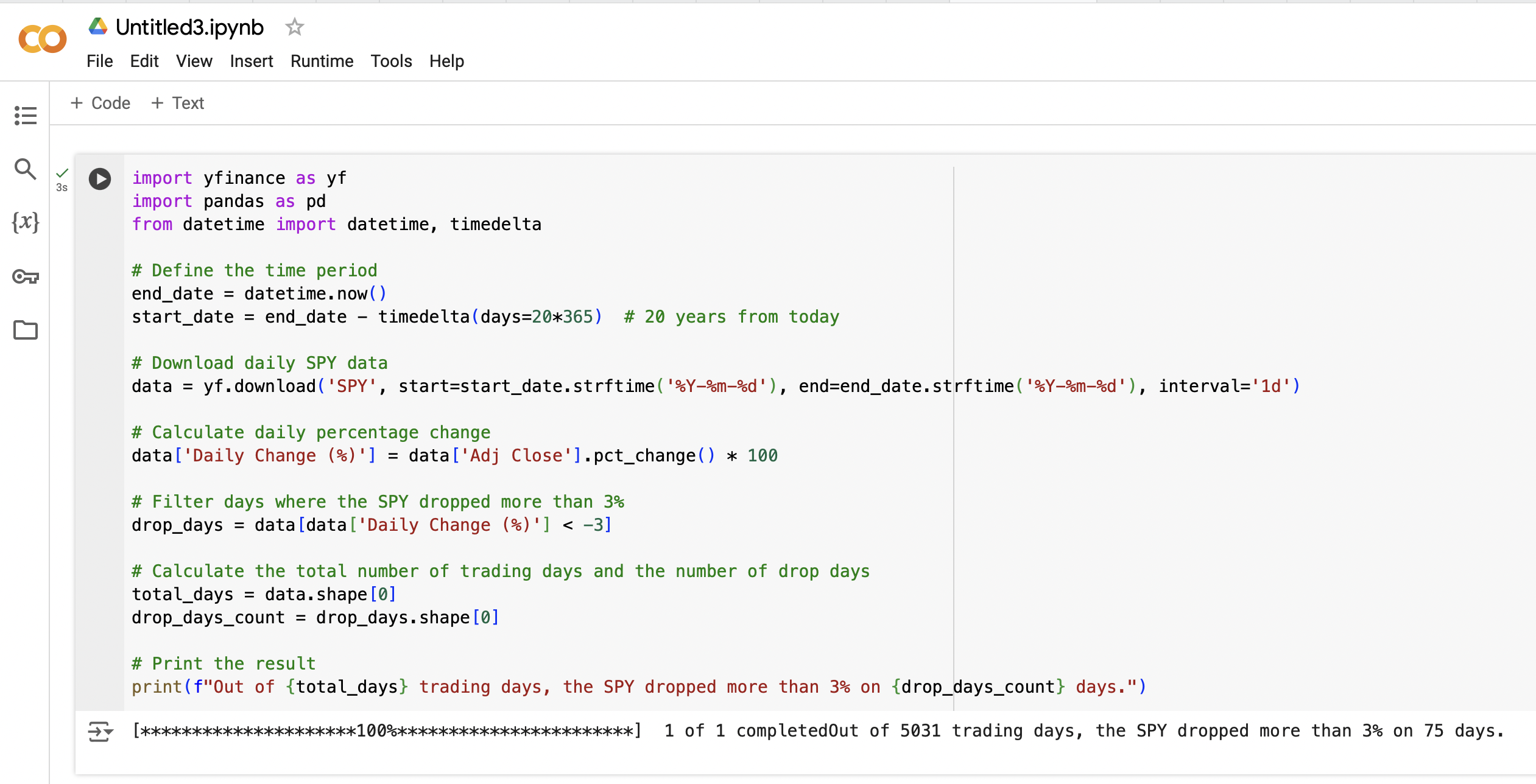

Just paste the code from ChatGPT in the cell where the cursor is and click the play button (yellow box).

After you clicked the play button you should get a status message '100% 1 of 1 completed' and the result like this 'Out of 5031 trading days, the SPY dropped more than 3% on 75 days.'

The code I got from ChatGPT you can access here.

What do you think? Empowering? Cool? And thats just the beginning.

Since you have seen how easy it is to get started with ChatGPT and Colab let's step back, look at the bigger picture why Python is so powerful and understand some basic python concepts.

Why Python is Perfect for Investors: Key Libraries

Python’s power lies in its specialized libraries that make complex financial tasks manageable. Think of libraries as toolkits:

Pandas: Ideal for data analysis, it lets you import, clean, and analyze large datasets. For example, with Pandas, you can calculate moving averages or break down returns by month, spotting patterns over different market cycles.

Matplotlib and Plotly: These libraries allow you to create charts and graphs that illustrate trends, such as comparing sector performances over a decade.

QuantLib: Used for advanced tasks like derivative pricing and risk management, QuantLib handles complex calculations that would otherwise require pricey software.

Learn What You Need, When You Need It

Thanks to AI, you no longer have to spend hours on tutorials or forums. Simply ask ChatGPT specific questions, like, “How can I backtest an RSI strategy?” or “What data can I get from yfinance?” ChatGPT not only provides the answer but also ready-to-use sample code, making learning fast and efficient.

Exploring Deeper with Machine Learning

Python is at the heart of AI advancements, including machine learning. You can use libraries like TensorFlow and PyTorch to create models that analyze financial data, even without being a data scientist.

Imagine building a machine learning model that analyzes factors like market sentiment or economic indicators and their effect on stock prices. Over time, you can refine your model to make smarter, data-driven investment decisions.

Pro Tip: Machine learning models may not always predict stock prices accurately, but they’re great for classifying market conditions and adapting strategies accordingly. Look up Deep Q-learning (DQN) if you’re curious—it’s challenging but opens up exciting possibilities.

Getting Practical with QuantConnect

Python brings rule-based investing to life on platforms like QuantConnect, where you can backtest and automate trading strategies in a ready-made environment. Say you want to test a strategy that buys the S&P 500 when it crosses above its 50-day moving average and sells below its 200-day average. With ChatGPT and QuantConnect, you can build this strategy, adjust parameters, and even run live simulations with “paper money” to build confidence before investing real funds. Once you are happy with your strategy, QuantConnect allows you to connect to your broker and execute the strategy on your behalf with the money in your broker account.

Python: Your New Investment Sidekick

Python isn’t just for programmers; it’s a valuable tool for investors. With Python, you can test any strategy with real data. Suppose someone says, “I made 16% last month using only this indicator.” You now have the tools to verify if it’s a consistent strategy or just a lucky month. Often, you’ll find there’s more to the story!

To the Future and Beyond!

Congratulations! You’ve taken your first steps into programming and data-driven investing with Python. With each question you ask and each line of code you run, you’re building a skill set that opens the door to deeper insights and more informed decisions. And this is only the beginning.

Welcome to the future—where Python and ChatGPT are your partners in navigating the world of investing.