SPY - The 10 best days!

SPY FOMO! You don't wanna miss out on the best SPY days.

This is a short but very insightful research.

Question

How much does your portfolio suffer when you miss the 10 best performing days?

Now you might be asking yourself, how could someone miss out on the 10 best-performing days? It’s quite simple. Investors often overreact when the market is down, thinking, "I’m fed up with the market's movements, I’m selling." These are the really bad days. So, they sell, but often the next day the market rebounds, and those who sold miss out on the gains.

The Test

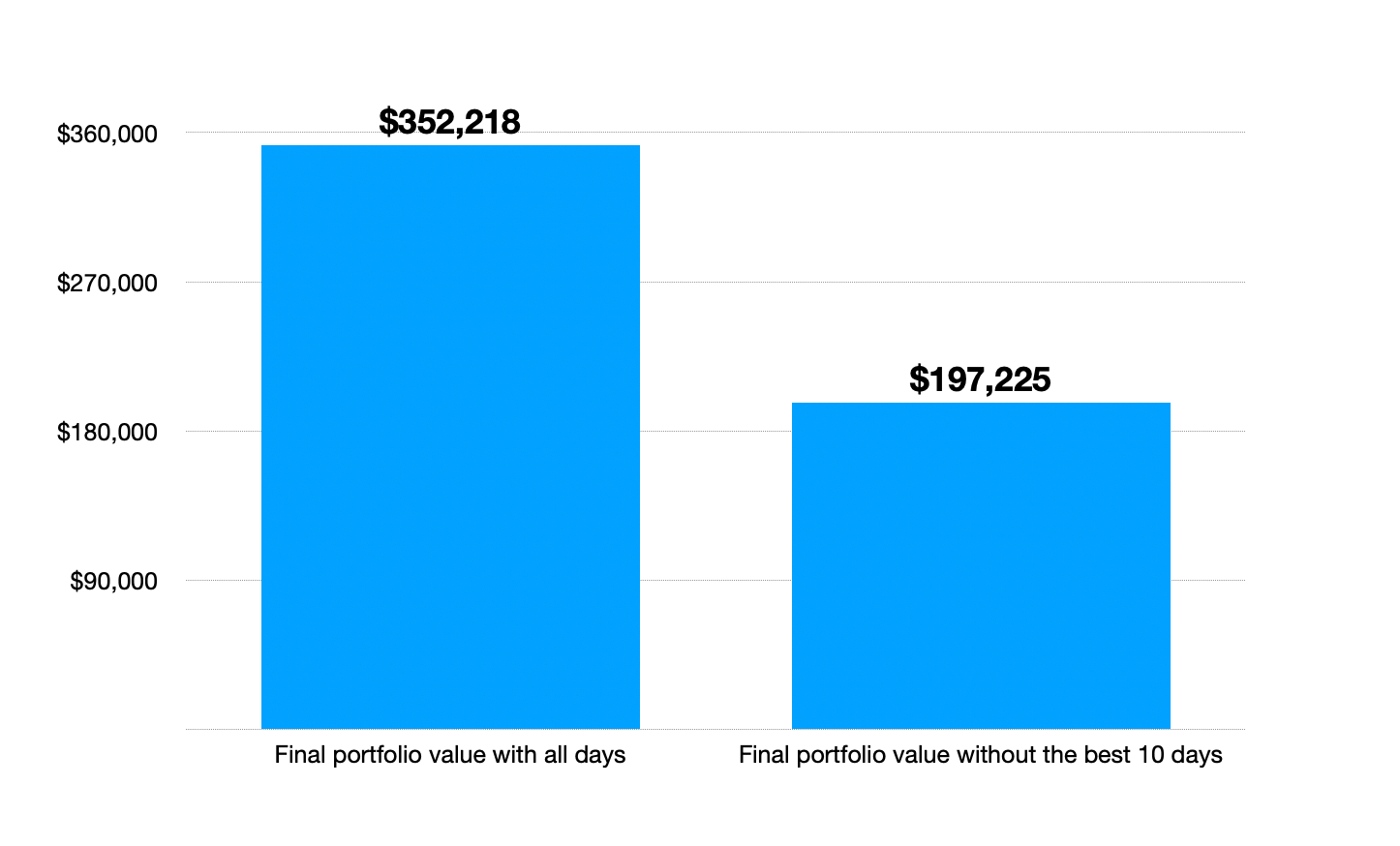

We invest $100,000 in 2014 and compare the 'buy and hold' strategy with and without the 10 best performing days.

The Results

With all days invested our portfolio value is around $350,000 in 2024. But when we miss the 10 best days during that 10 year period our portfolio would only be worth around $195,000. That is $155,000 less by only missing 10 days!

We miss 44% of the 'Buy and Hold' performance!

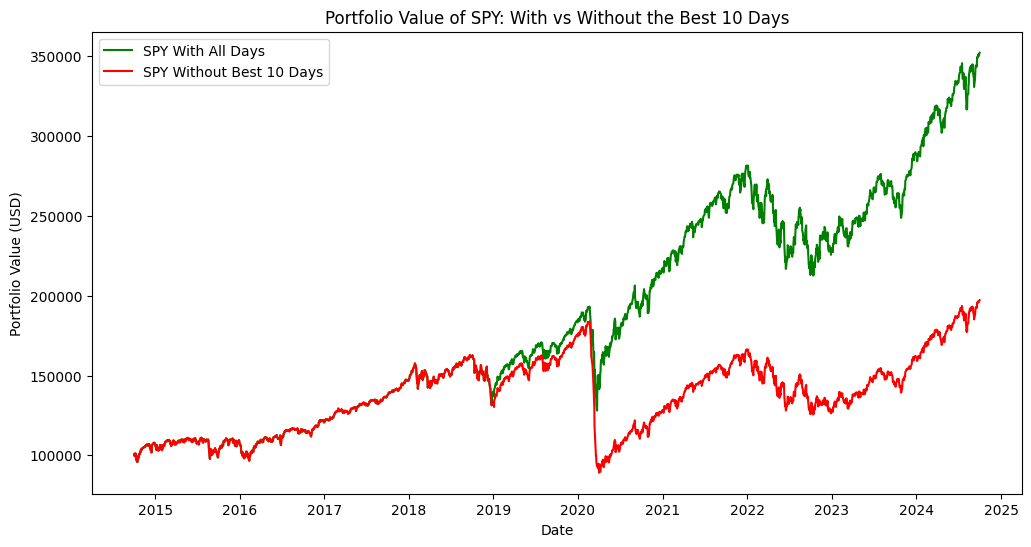

Plotting the portfolio values over time we can see that the majority of the difference came from the strong movements in early 2020, during the COVID crash.

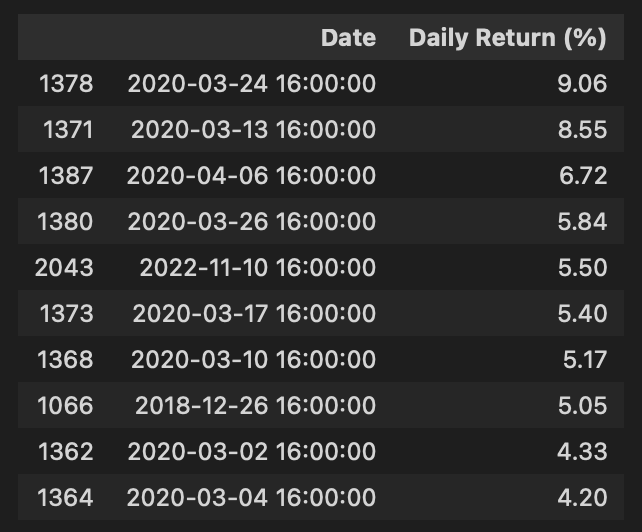

In the list below we see that 8 of the 10 best performing days occurred during the COVID crash in March and April 2020.

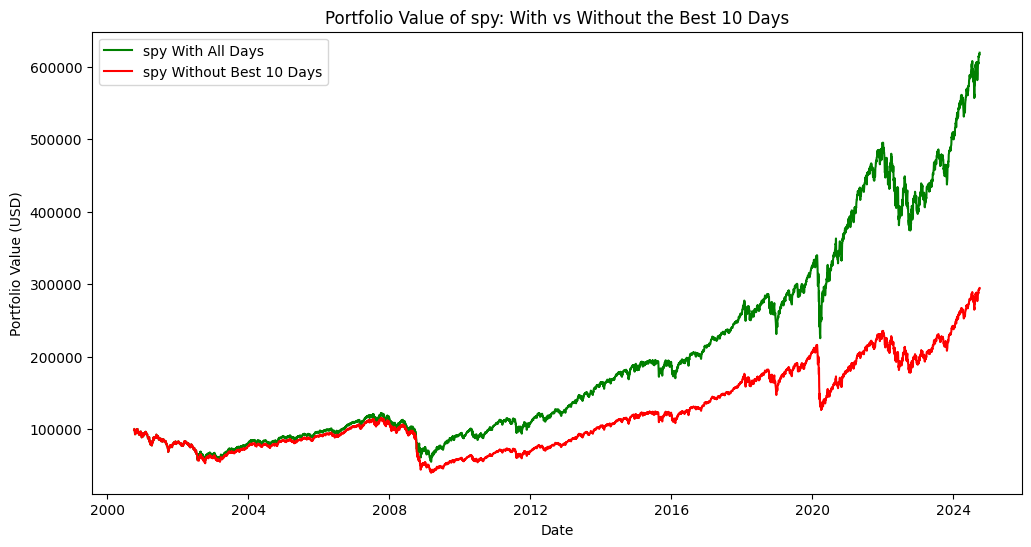

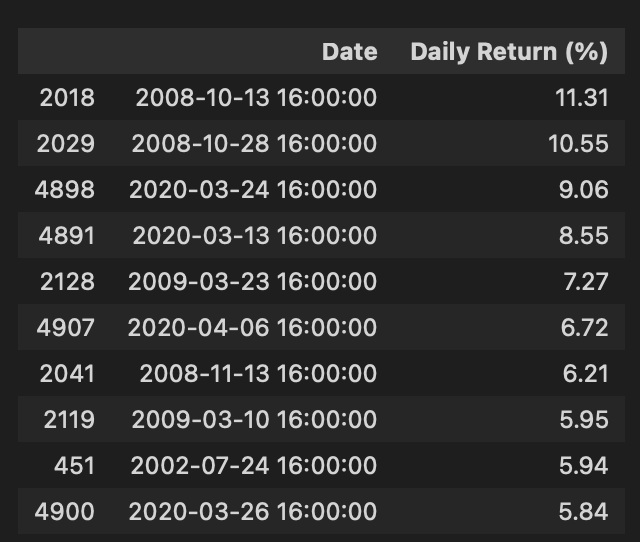

The 24 year period from 2000 to 2024 delivers or even worst results. We loose 52% if we do not get the return of the best 10 days. This means our portfolio value is roughly half by just missing 10 days.

The top performing days we are missing appear again in the period where we have market crashes like in 2008/09 and in 2020. This is where the gap is created.

How about Tesla and the last 5 years?

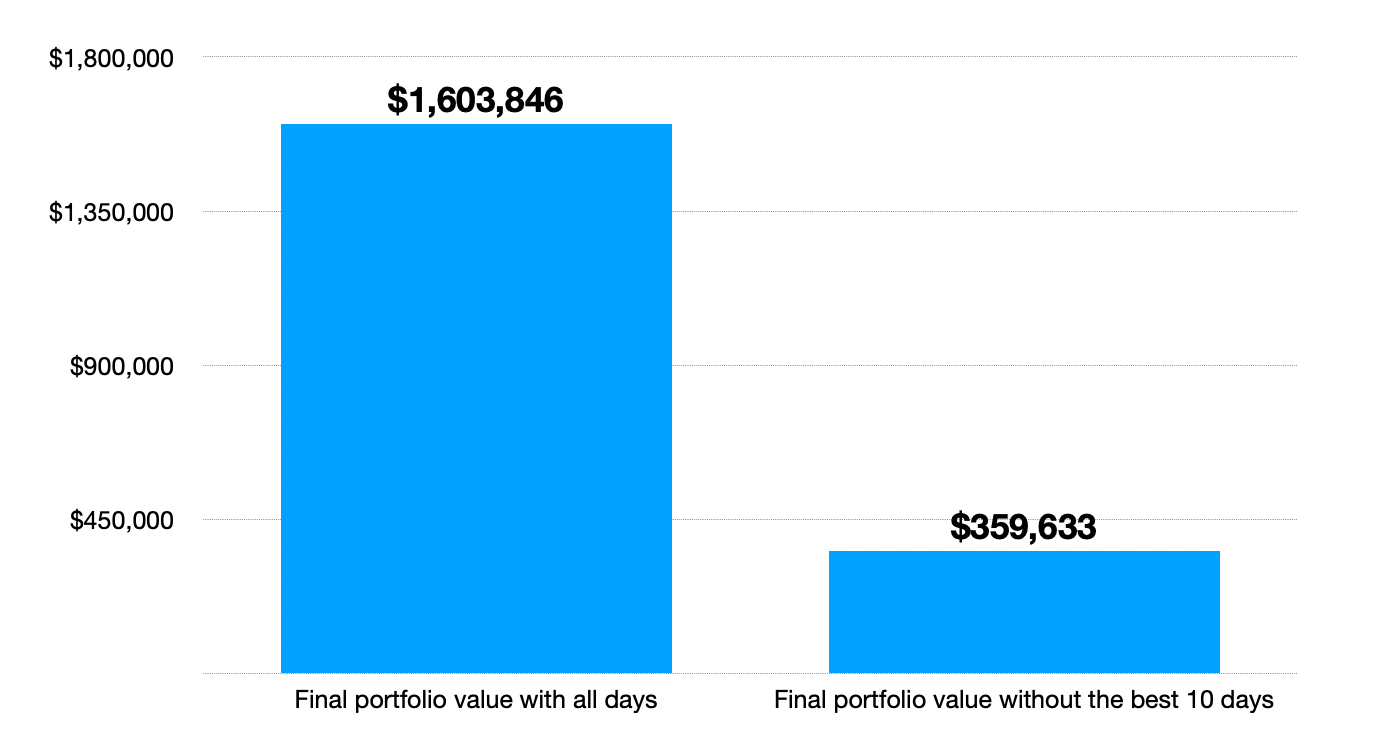

This is even more dramatic! We loose 77% of the performance over 5 years by missing the 10 best days.

$100,000 invested in Tesla 5 years ago in 2019 would amount to a breathtaking $1.6 million with a buy and hold strategy. But if you missed the 10 best days, you would only have $360,000.

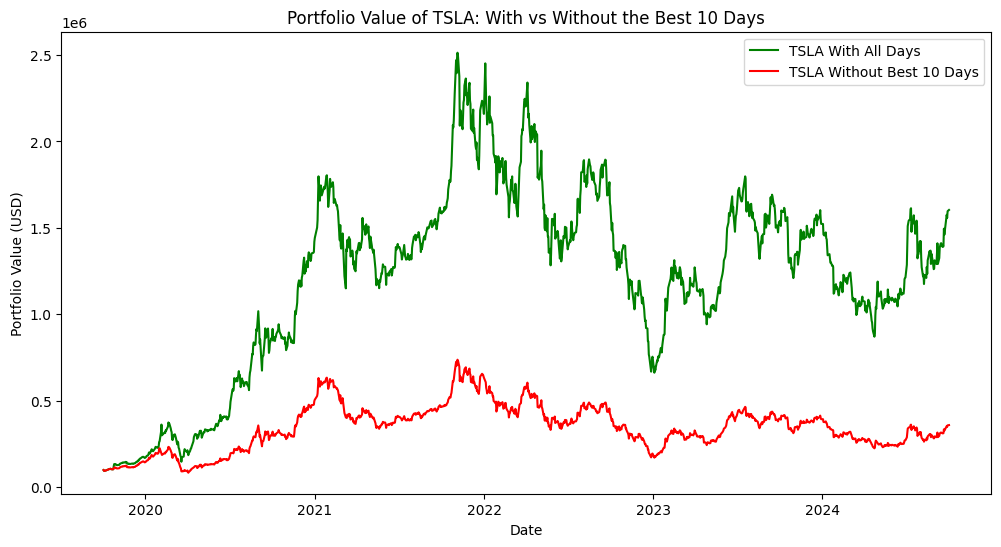

Looking at the portfolio values over time - what a massive difference!

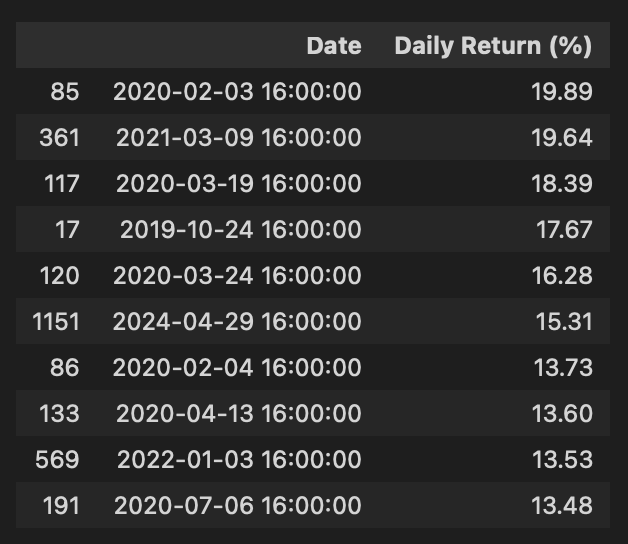

Tesla's best 10 days have all a daily return of more than 13%. Clearly missing these is not a good thing! But remember they occur in phases when Tesla also had big moves to the downside. That's an eye opener! Isn't it?

Conclusion

Don't miss the best 10 days! Easy! Right?

Thats not so easy psychologically, because the best 10 days occur in periods when markets are in a corrective phase. When everyone is talking about the stock market crash and running around with their hair on fire you will have to whisper your mantra: 'I will not panic, I will not sell and I will not miss the 10 best days!'

Reality is that many investors consider selling when the prices are falling and therefore increase their risk of missing out on some of the best recovery days.

This analysis makes it clear that 'time in the market' is often easier and more powerful than 'timing the market', unless you have a clear defined strategy you can backtest and know how it has behaved in the past.