Take Profit or Not?

Johannes asked me a question last night.

This year, my investments have performed very well. Should I sell and take profits, or wait for a year-end rally?

Johannes is a finance professional, and I think it’s partially a trick question! 😀 But many people ask themselves this exact question, especially in a market like 2024. Before I go play pickleball, I wanted to give Johannes—and all of you—a quick response with some historical data. I did some basic number crunching with Yahoo Finance data and Python Jupyter Notebooks. If you want these notebooks to play around with, just message me or leave a comment.

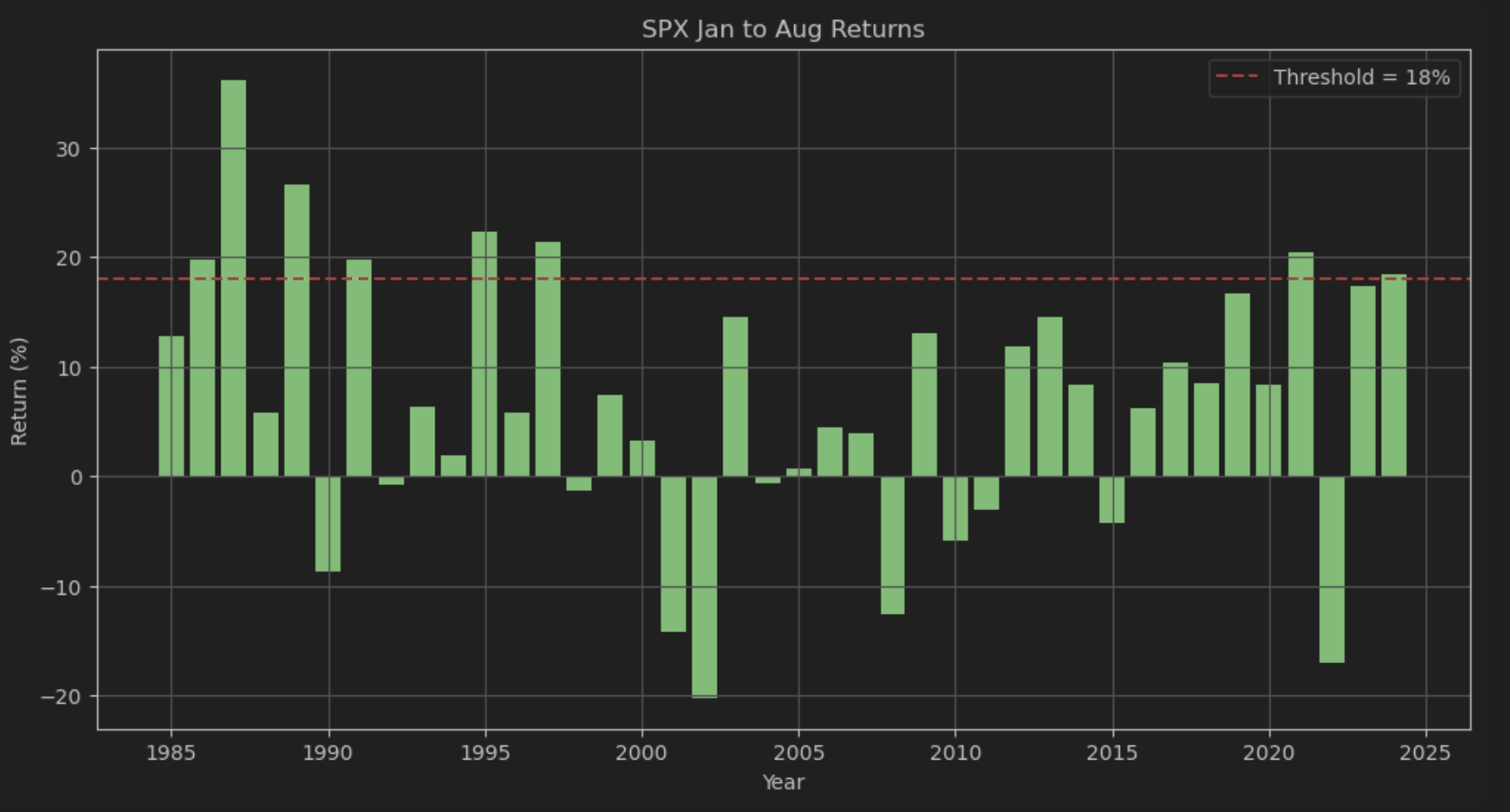

Let’s look at the S&P 500, the index that the SPY ETF tracks. The return so far—January until the end of August this year—is around 18%.

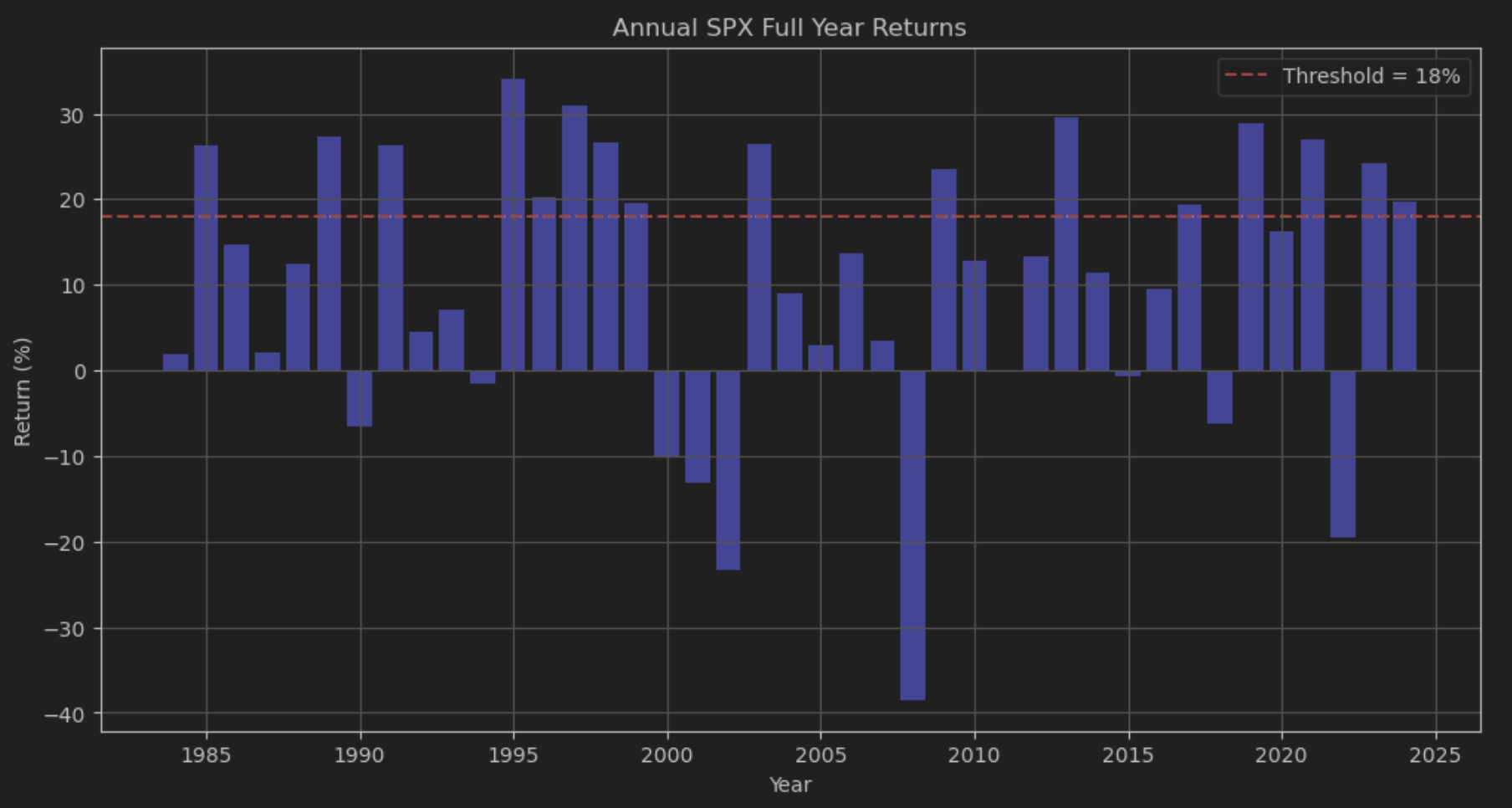

Over the last 40 years, there were 16 years with a return higher than 18%.

But if we look at the first eight months of every year (January to August) and calculate the returns, only 8 times in 40 years has there been a better (8-month) performance than 2024. Historically speaking, we are having a fantastic year so far.

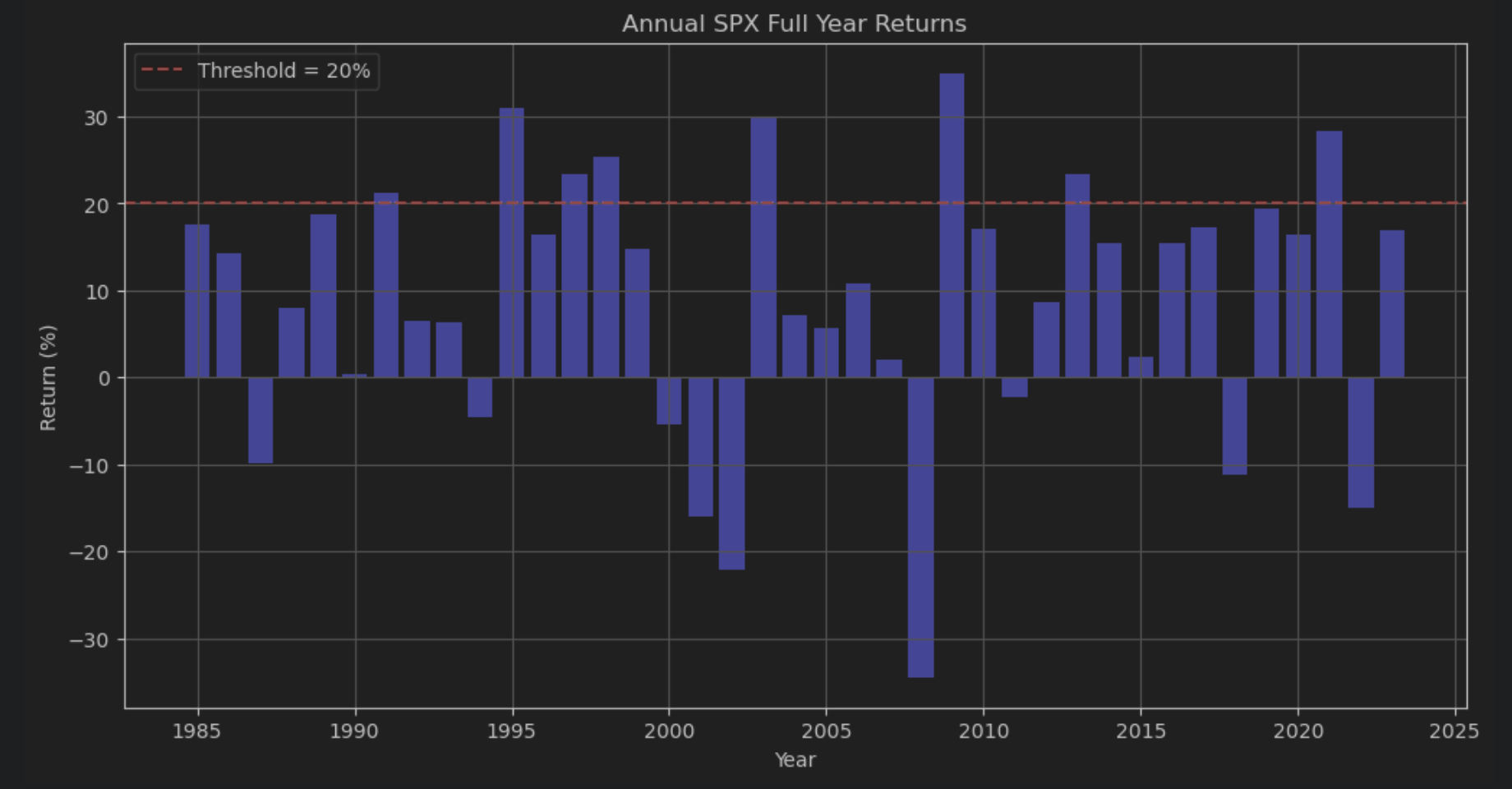

As of today, September 20th, 2024 the Year-to-Date return of the S&P500 is around 20%. Only 8 times in history (since 1984) there has been more than 20% return for a full year. Remember we have still four month to go!

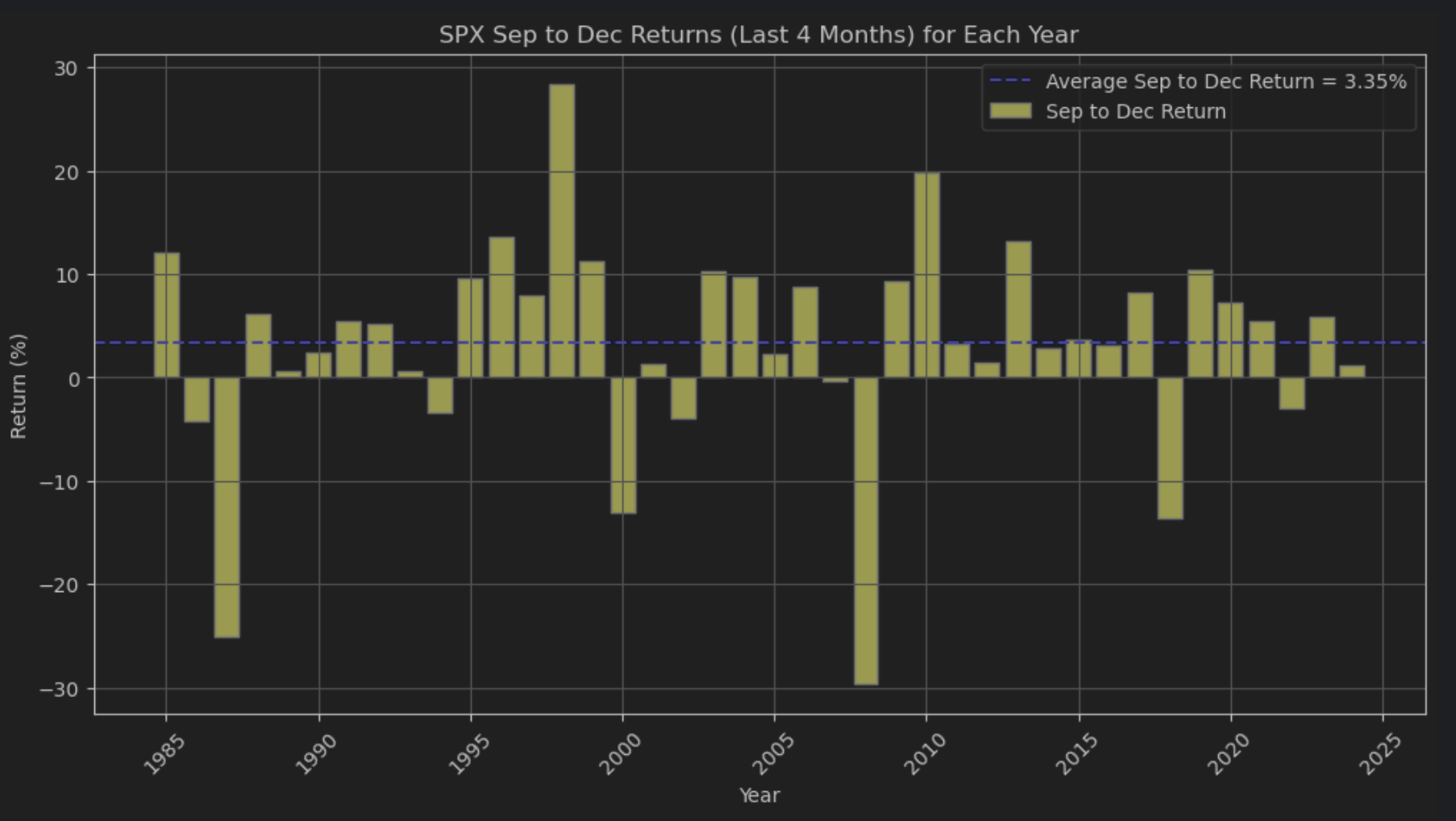

How was the S&P 500 return for the last four months of each year? This shows how much we would have given up by selling in September. On average, we got a 3.35% return in the last four months of the year (blue dashed line). Only 9 of the last 40 years had negative returns in the last four months of the year.

This does not directly answer Johannes’s question, but it shows that 2024 is performing well above the historical average and is exceptional as of today.

This question highlights that investing has an emotional aspect. Are we being too greedy or too fearful? It’s not easy to answer.

One way to address this is by defining investment strategies in a quantifiable and objective way, like we did with the Moving Average Strategy. Once we define clear rules for when to buy and when to sell, we can backtest the strategy and run a Monte Carlo simulation. If we like the test results, we can consider following the strategy in a simulated account and then with real money.

What do you think? Should we sell and take profit? What is your exit rule?