Select your Broker

How do you select your broker? Do you even need one?

Recently I visited a big shopping mall in Asia and was sincerely impressed. 500 shops, over 100 restaurants and all I wanted was a pair of socks. I was a bit overwhelmed. On the ground floor I navigated through the colorful themed restaurant section, than I made my way through the French luxury brand flagship stores, turned the corner at the NFT Electronic Art Gallery and passed the Porsche dealership, than I found myself in a Japanese Department store in front of the suitcase section on the right and the Koi fish section on the left. I totally forgot about my socks!

What has happened in the investment world is almost the same. The amount of investment products has risen exponentially and the number of brokers has increased as well. How do you select a suitable broker?

Do I even need a broker?

The simple answer is yes. You might decide to buy your investments at your local bank because they give you advice and you trust them, but in the end the bank will place your buy order with a broker. The broker's job is to buy and sell securities (stocks, ETFs bonds, etc) at the exchange. The bank also has to use one and often they use their own in-house broker. But with cheaper and faster technologies we all have access to efficient online brokers with much lower cost. Think of how Uber has broken the monopoly of taxi companies for the benefit of lower costs for users. The same happened in the investment world.

But first let's go back in time. Who is this shouting man in the blue jacket?

He was once a very important person in the world of stock exchanges. He was a floor broker. If you wanted to buy shares in - for example - General Electric back in the 70s or 80s, you would have called your broker and told him: “I want to buy 100 shares of GE” After that, your broker’s assistant confirms the details, and the order clerk writes it up. The messenger will now take it to the trading desk clerk, who relays it to his telephone operator colleague. He calls the exchange clerk, who hands it to the runner with a bright yellow shirt. Now the craziness begins. The runner gets it to the floor broker (the guy in the dark blue jacket), who’s yelling prices alongside a specialist and floor traders. Once the trade is done, a back-office clerk enters the details, and the reconciliation clerk checks for mistakes. The confirmation clerk mails the details to you (notice there is no 'e' in front of 'mail'), while a settlements clerk and stock certificate clerk sort out the final paperwork. Finally, a statement clerk sends your monthly report. That’s 20 people for 100 shares in 1973 and each of them needed to get paid.

Today you can open an online broker account in minutes, push a button on your smartphone and seconds later you have bought 100 GE shares. But that s not all. New technologies enable you to connect directly with a broker platform via an API - which is a way computers can talk to each other - and buy and sell fully automated, based on rules you tell your computer, like the Moving Average strategy. This is called algorithmic trading. It might seem complicated if you’ve never done it, but it’s absolutely doable at very low cost.

How to select a broker?

Before you send your money to someone - check that it is a registered broker you are dealing with. Do not send your money to a company which is not regulated and registered. The likelihood that you will lose your money is too high. In 2023 the FTC (Federal Trade Commission) reported that $4.6 billion had been scammed globally related to investments. These are cases where someone transferred money to a company who has not been registered nor regulated.

US Regulated Brokers

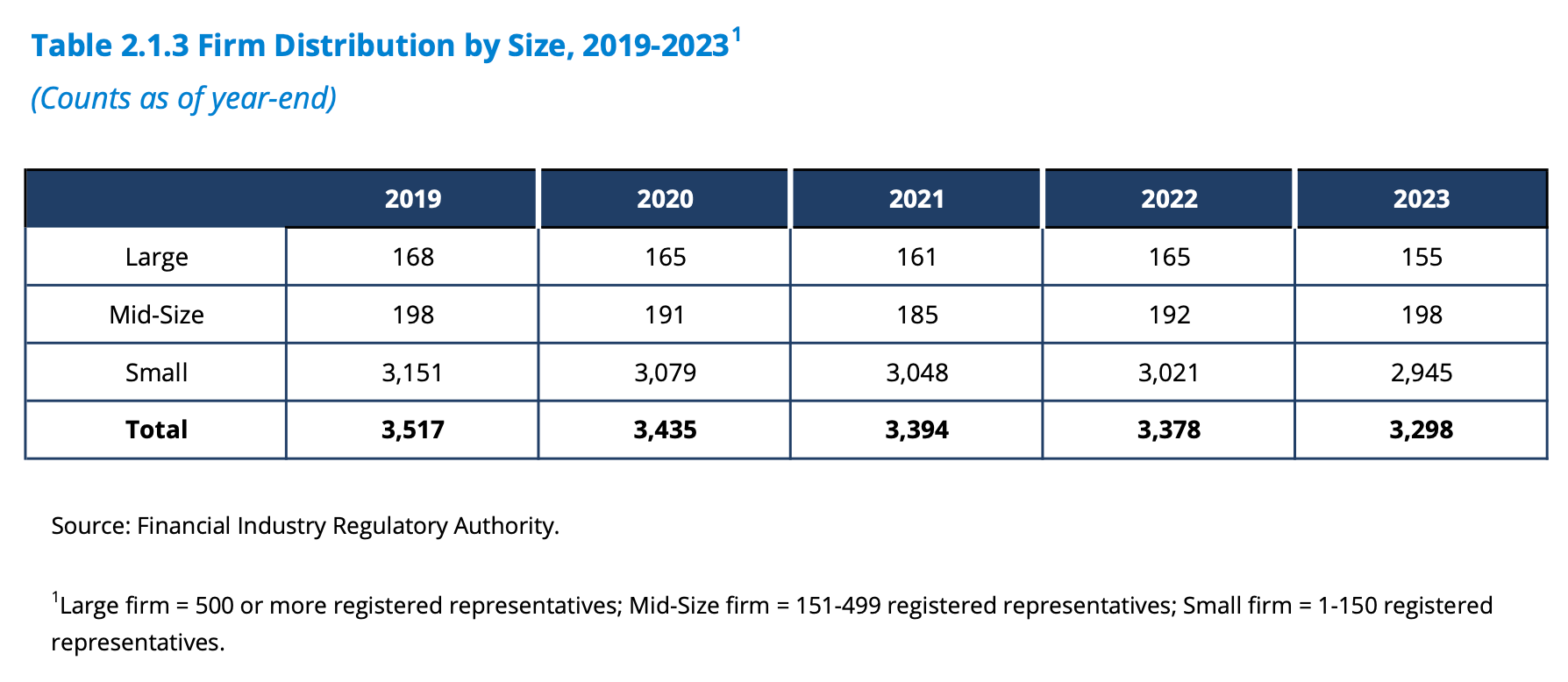

In the US, the Financial Industry Regulatory Authority (FINRA) regulates brokers. As of 2023 there have been 3,298 registered brokers in total. 155 of them classified as large brokers with more than 500 registered employees.

The FINRA's job is to protect investors and make sure the market access is fair. They have educational content for investors and also a database called BrokerCheck by FINRA where you can do a background check on any US registered broker.

A good starting point to create a shortlist of brokers is Investopedia and their 'The Complete Guide to Choosing an Online Stock Broker'. Be aware, they are getting paid by affiliate marketing programs, although they promise to stay impartial in their editorial policy. Despite this, it’s still a great resource to get started.

Investopedia recommends Charles Schwab as 'best for beginners' and Fidelity as 'best for low cost'. Well! Let's run a BrokerCheck on Charles Schwab.

Here you find a lot of details and there are two areas you want to check. First you want to click on Relationship Summary. This is a document the broker has to produce and file with FINRA. It's an official document with no marketing allowed. It details the types of services a firm offers, the fees and costs, conflicts of interest they may have and whether the firm or its individual employees have reportable legal or disciplinary history.

If you want, you can read the Detailed Report and find out if the broker had to pay any penalties. In the case of Charles Schwab the document is 300 pages long!

What you will find is that Schwab paid $45.9 million in disgorgement (gains which should have been attributed to clients but weren’t.), $5.6 million in prejudgment interest, and a $135 million civil penalty. This total amount was placed into the 'fair fund', ensuring that it was not simply absorbed by the government but rather distributed to Schwab clients. The 'fair fund' mechanism is designed to prioritize compensating broker clients, rather than using the money for governmental purposes. This system demonstrates the stringent regulatory environment in the US that aims to protect investors directly through financial compensation mechanisms in cases of broker mistakes.

This differs from Europe, where large penalties are often paid directly to governments rather than creating funds for affected investors.

When choosing between a US or non-US broker, it’s important to know that compensation payments from fines or settlements with US-registered brokers are available to all affected clients, not just US citizens. This is because US regulators like the SEC (Security and Exchange Commission) and FINRA work to ensure transparency and fairness in the US financial markets, protecting investors worldwide.

Most US brokers are members of SIPC (Securities Investor Protection Corporation), which protecting customer accounts up to $500,000, including $250,000 in cash, in case of broker insolvency. Some brokers, like Interactive Brokers, offer additional excess SIPC insurance with coverage up to $30 million. This protection applies to all customers, regardless of nationality. However, be aware ... SIPC doesn’t cover market losses from poor investments!

When it comes to US registered brokers outside the US, Interactive Broker is clearly the king - operating in 33 countries worldwide. If you are based in Hong Kong, Singapore or the UK, then Charles Schwab is a potential option.

Non US Regulated Brokers

While US-registered brokers like Schwab and Interactive Brokers offer many advantages, you might also want to consider non-US brokers, depending on where you’re located. Non-US brokers can provide access to local markets and may offer tax advantages or more tailored services.

For instance, if you’re based in Europe, brokers like Saxo Bank or DEGIRO are well-regarded. Saxo Bank is known for offering access to a broad range of global markets and has a strong reputation for customer service. On the other hand, DEGIRO, based in the Netherlands, offers extremely low fees, making it a popular choice for European investors looking for a no-frills, cost-effective platform.

In Asia, brokers like Tiger Brokers or Monex are very popular and providing access to Asian markets.

Check if the broker you choose is regulated by a trusted authority in your region. For example, European brokers are regulated by ESMA (European Securities and Markets Authority).

The same applies to Asia and other regions, simple ask ChatGPT - "Who regulates investment brokers in ...", you will see almost every country has a regulator where you can check your broker and find out if he is authorized and registered in your country.

Specialty brokers

When you become an intermediate or advanced investors there are additional choices. If you trade products like futures, options and currencies including crypto currencies there are specialty brokers.

We will talk about these brokers when we discuss strategies for options, futures and currencies (including crypto). For now let me show you one broker for those interested in options trading. Tastytrade is a broker mainly focused on options. Not only do they offer a simple accessible option education and trading platform, they also have a very active YouTube channel with several live shows explaining option trading strategies.

Brokers with APIs

If you elevate your investing to the next level you might want a broker with an API. This lets your computer send buy and sell orders to the brokers computer, based on the rules you established. This is called algorithmic or rule-based investing and trading.

This is not for everyone, nor does that guarantee you better performance. But what it does is that you can let the computer do the hard work while you focus on strategy development and monitoring.

Do I hear, ‘I don’t know how to do that!

Do not worry! With the arrival of AI we are no longer limited to what we know. We need to learn to ask the right questions. If you know what questions to ask, you can achieve so much.

In future posts we will slowly guide you through this process and I guarantee you it is much simpler than you think!

You can do this! - Stay tuned!