Beyond the P/E Ratio: Smarter Metrics and Strategies for Modern Investors

The P/E ratio is an investors favorite, but is it truly reliable? In this post, we discuss its hidden flaws, explore smarter valuation metrics, and showcase the power of systematic backtesting.

The P/E ratio is like the superstar of stock valuation—quick, simple, and practically everywhere you look. But here’s the thing: while it gets a lot of love, the P/E ratio is also one of the most overrated and misunderstood tools in investing.

In this post, we’ll break down why the P/E ratio is often unreliable, explore four alternatives for better stock evaluation, and show how systematic backtesting can identify the metrics that truly matter.

What is the P/E Ratio?

The P/E ratio is calculated as:

Let’s use Apple (AAPL) as an example. Suppose Apple’s stock is trading at $150 per share, and its earnings per share over the past year is $6. This gives Apple a P/E ratio of 25 (150/25=6). Investors, in this case, are paying $25 for every $1 of Apple’s annual earnings.

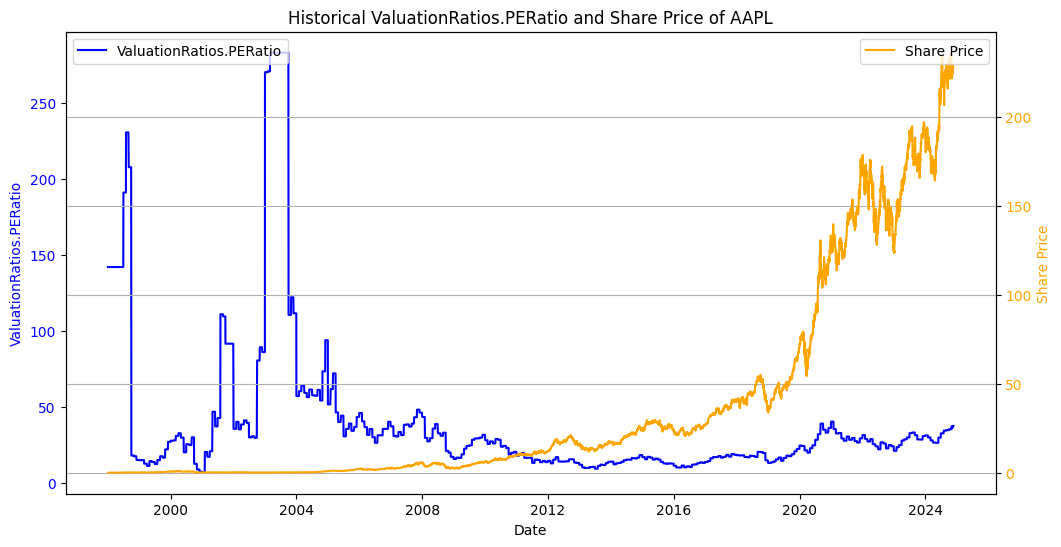

This simplicity is why the P/E ratio is so popular. However, as shown in the chart below, relying on it alone can be misleading.

The chart highlights Apple’s historical P/E ratio (blue line) alongside its share price (orange line). While the P/E ratio fluctuated wildly during speculative periods, Apple’s share price rose steadily over the long term. This divergence suggests that long-term growth might depend more on a company’s fundamentals than on valuation metrics like the P/E ratio.

4 Reasons the P/E Ratio Doesn’t Tell the Full Story

1. It Oversimplifies Everything

The P/E ratio distills a company’s entire story into one number, ignoring factors like growth potential, industry trends, and earnings quality. It’s like buying a helicopter or a submarine based only on its price tag, without considering its performance or reliability 🤣. Ok! ... or a car!

2. Forward P/E: Guesswork in Disguise

There are two P/E versions:

• Trailing P/E: Based on past 12 months’ earnings.

• Forward P/E: Based on analysts’ predictions for future earnings.

Forward P/E can make stocks look cheaper due to overly optimistic forecasts. For example, a trailing P/E of 25 might drop to 20 if analysts expect higher earnings. But if those predictions don’t pan out, you’re left with a misleading valuation.

3. It’s Vulnerable to Accounting Tricks

Earnings, the denominator in the P/E formula, are easy to manipulate even within the framework of accounting rules. Companies might delay recording expenses or reclassify costs to inflate profits. These legal accounting flexibilities make the P/E ratio look more attractive but distort the real picture.

4. It Lacks Context

The P/E ratio without context is just a number.

• Is it high or low compared to the company’s history?

• How does it compare to industry peers?

• What’s happening in the broader market?

Without this context, the P/E ratio can lead to poor decisions, like judging $100 as “expensive” without knowing whether it’s for sneakers or a plane ticket.

Four Alternatives to the P/E Ratio

If the P/E ratio isn’t reliable, what should you use? Here are four alternatives:

1. Price-to-Book (P/B) Ratio

The P/B ratio measures a stock’s price against its book value (assets minus liabilities). It’s especially valuable for asset-heavy sectors like banking and real estate.

For instance, if a company has $500 million in book value and a $1 billion market cap, its P/B ratio is 2.

2. Price-to-Sales (P/S) Ratio

The P/S ratio compares a stock’s price to its sales ie revenue per share. Since revenue is harder to manipulate than earnings, this metric is particularly useful for evaluating companies with inconsistent or negative earnings.

For example, if a company generates $1 billion in revenue and has a market cap of $4 billion, its P/S ratio is 4.

3. Price-to-Cash Flow (P/CF) Ratio

The P/CF ratio compares a stock’s price to its operating cash flow, offering a clearer picture of financial health.

For example, if a company generates $200 million in cash flow and has a market cap of $1 billion, its P/CF ratio is 5.

4. Net Current Asset Value (NCAV)

The NCAV ratio measures a company’s market price against its liquidation value, focusing on the net current assets (current assets minus total liabilities). It’s a conservative approach designed to identify deeply undervalued stocks with a high margin of safety.

For instance, if a company has $500 million in current assets and $300 million in total liabilities, its net current asset value is $200 million. If the company’s market cap is $150 million, the NCAV ratio is 0.75, suggesting the stock trades below its liquidation value.

Don’t Just Believe It — Test It!

While these metrics offer deeper insights than the P/E ratio, the key to understanding their effectiveness is testing them. Backtesting is a systematic process that evaluates how a strategy performs using historical data. Let’s see how this works with the BG Bargain Hunter.

Case Study: The BG Bargain Hunter

Last week we discussed The BG Bargain Hunter strategy. It’s a great educational example for why we encourage you to explore quantitative investing and automated platforms like QuantConnect.

This strategy shines in its systematic approach, applying filters to analyze thousands of companies and select only the most undervalued opportunities based on metrics like the Net Current Asset Value (NCAV). Imagine manually screening 3,000 companies, calculating financial ratios, and rebalancing your portfolio quarterly—it would be an exhausting, error-prone task. Algorithmic trading eliminates these challenges by automating data analysis and trade execution, ensuring precision and scalability.

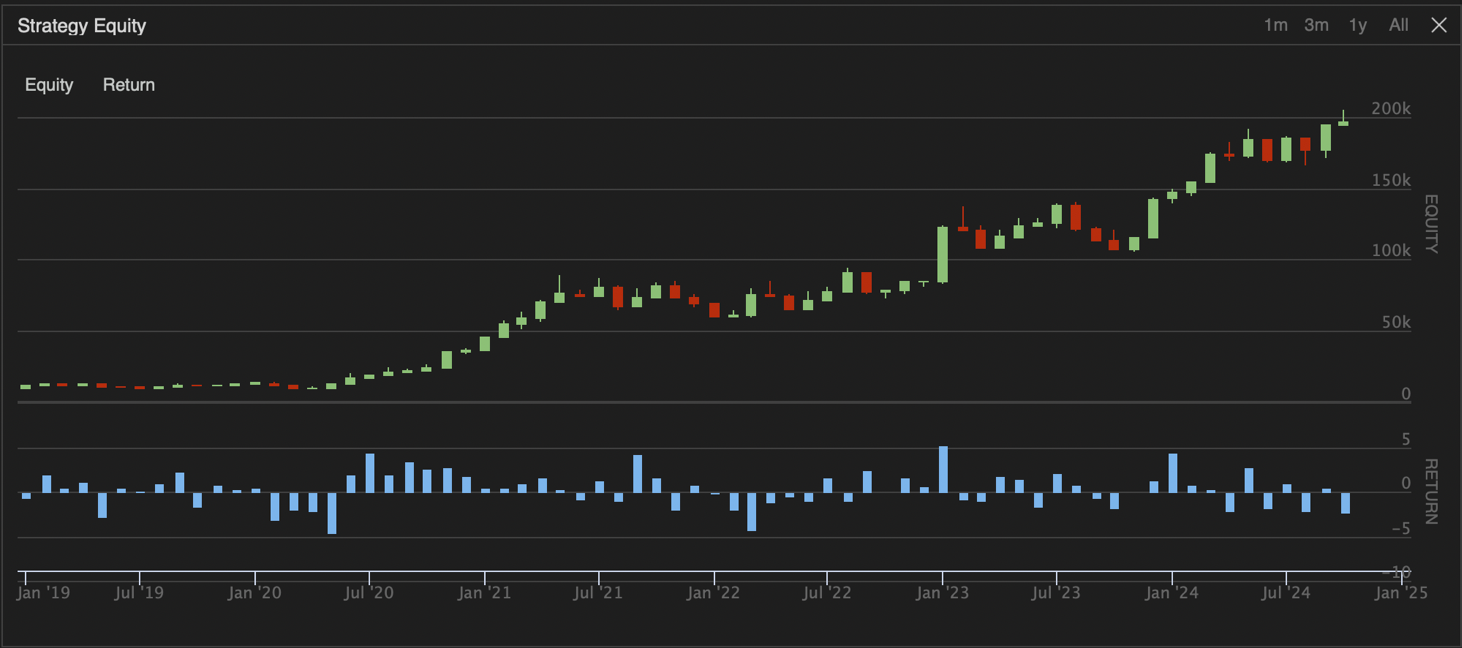

The strategy turned $10,000 into $200,000—a 66% annual growth rate in a 5 year backtest. That is an indication that the NCAV as a balance sheet ratio is worth to analyze.

Side note: 10 years ago, this strategy would not have been available to private investors because the tools and data needed for such systematic analysis were restricted to hedge funds and institutional traders. Today, platforms like QuantConnect have democratized access, offering retail investors the ability to harness the same power of data-driven strategies and advanced backtesting tools.

How the Strategy Works

1. Finding the Right Stocks

Out of thousands of companies, the strategy looks for those that are deeply undervalued. It uses the Net Current Asset Value (NCAV) to ensure the companies selected have a strong margin of safety.

2. Adapting to Market Conditions

Depending on how the market is performing, the strategy adjusts. If the market seems strong, it invests in stocks. If things look uncertain or risky, it moves into safer assets like gold.

3. Building a Balanced Portfolio

Once the stocks are chosen, the strategy spreads the investments equally across them. To boost potential returns, it also uses a calculated amount of leverage (borrowing a bit extra to invest).

4. Managing Risk:

To keep things safe, the strategy limits how much can be lost on any one stock and ensures the investments are spread out. This helps protect the portfolio if some stocks don’t perform well.

5. Sticking to a Schedule:

Every three months, the strategy reviews and updates the portfolio. This disciplined approach avoids emotional decisions and keeps things running smoothly.

By combining these 5 steps, the strategy creates a systematic, consistent way to invest—one that’s hard to replicate manually but becomes manageable with the help of automation.

Backtesting Results

• 66% Annual Return: Turning $10,000 into $200,000 in five years.

• Sharpe Ratio: 1.48, reflecting favorable risk-adjusted returns.

• Drawdown: A maximum of 37.8%, highlighting the strategy’s volatility.

A Word of Caution

While backtesting reveals valuable insights, it doesn’t predict the future. Markets change, and strategies must adapt. However, backtesting is an essential first step for evaluating how metrics like NCAV perform, guiding refinement before real-world application.

Final Thoughts

The P/E ratio may be a stock market staple, but its flaws make it unreliable as a sole valuation tool. Alternatives like Price-to-Book (P/B) Ratio, Price-to-Sales (P/S), Ratio Price-to-Cash Flow (P/CF) Ratio and Net Current Asset Value (NCAV) ratios offer deeper insights into a company’s value.

The real key lies in testing these metrics systematically. As shown by the BG Bargain Hunter, quantitative strategy backtesting uncovers what truly works and highlights the potential of data-driven strategies.

Ready to move beyond the P/E ratio?

PS: Have you realized how funny AI is when it comes to generating pictures. The spelling capabilities are at par with a 5 year old. 🤣

By the way - Tucker loves Quant Investing because he gets more attention.