Let's talk about "Buy and Hold"

"Buy and Hold" - an investment strategy many talk about. "I just buy and hold". But does it work? Over the last 30 years the SPY ETF generated an average annual return of 10.4% per year. But it comes with a catch.

"Buy and Hold" might be the simplest investment strategy known to mankind and often used as a reference or benchmark for professional portfolio managers. As the name says - you buy and hold. Easy! And in some circumstances very powerful.

Let's Buy and Hold

If you are young and invest for your retirement which is at least 30 years away from today "Buy and Hold" might work just fine. Let's use the SPY ETF for example. This is the first Exchange Traded Fund (ETF) introduced to the market in 1993.

ETFs allow investors to buy and sell shares of an ETF throughout the trading day at market prices, similar to how stocks are traded. This innovation aimed to offer a diversified investment that closely tracked the performance of a specific index, in this case, the S&P 500, while providing lower costs and greater flexibility compared to traditional mutual funds. As of today there are around 3,800 ETFs available for us to buy. We will talk about them in later posts.

When you buy a SPY ETF you basically buy a small fraction of all companies who are in the S&P500 index. The SPY is so famous he will get his own post in the future.

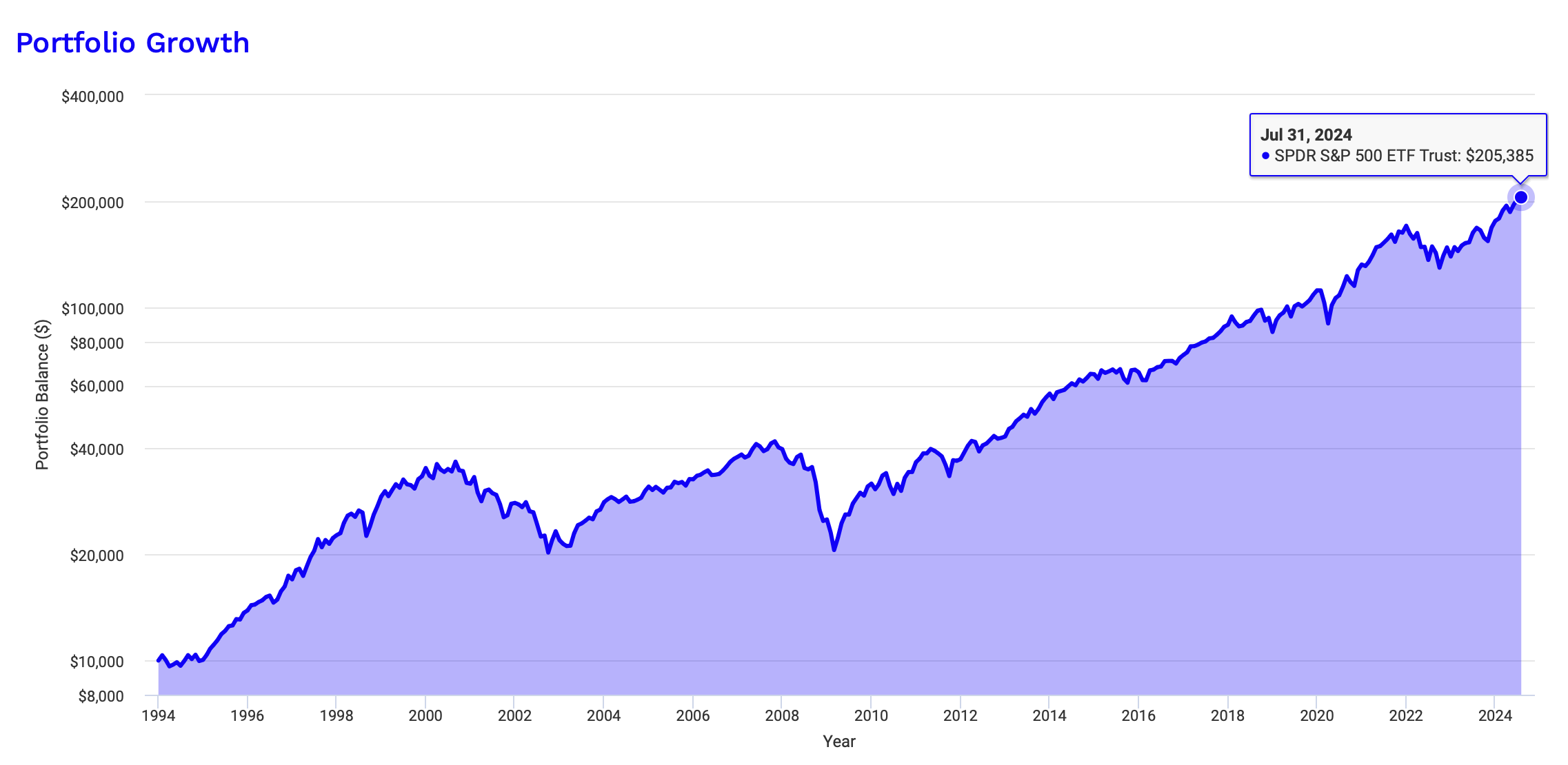

Let's do a test! We switch on our time machine and fly back into 1994 and buy all the SPYs we can get for $10,000. Over these 30 years the SPY generated an average annual return of 10.4% per year. $10,000 invested in 1994 is worth now in July 2024 $205,385 - assuming the dividends are reinvested.

10.4% average annual return is great. We didn't work hard for it! Actually there was no work involved. We simply bought and held. This must be the easiest investment strategy ever!

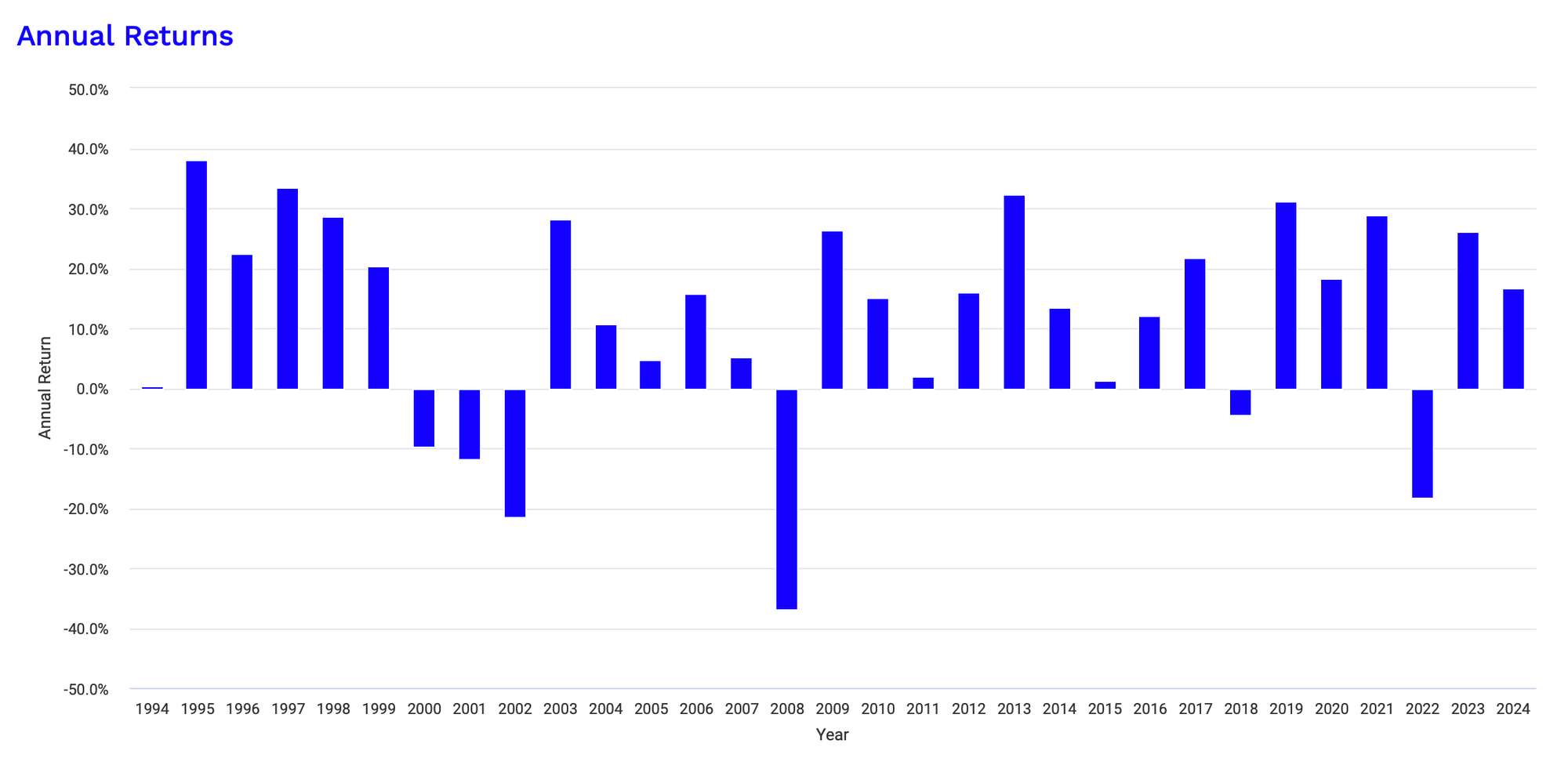

What's the catch? Here it comes. Unfortunately an average return of 10.4% does not mean I get every year 10.4% of capital credited into my account. If we are looking at each year we can see the annual returns vary quite significantly. 38% in 1995 and -37% in 2008 are the two extreme return values over this 30 year period. Basically you need to fasten your seatbelt and enjoy the ride. There is a bit of a roller coaster feeling associated. This nice 10.4% average return comes with a catch and this catch is called volatility.

Volatility is the degree of variation in the price over time and can be measured and expressed in one number for a certain period. For example if we say the SPY has a one year volatility of 20% and the SPY price is currently $500. A 20% annual volatility suggests that the price could typically be expected to move within a range of $500 ± 20% over the next year with a probability of 68%. This translates to a potential price range of:

• Upper range: $500 + (20% of $500) = $500 + $100 = $600

• Lower range: $500 - (20% of $500) = $500 - $100 = $400

When someone recommends you an ETF, a stock or any other investment product or investment strategy you should always ask - "What is the annual volatility?" This will give you a good feeling for the risk associated. We will talk about volatility in more details in one of our next posts.

The "Lost Decade" Problem

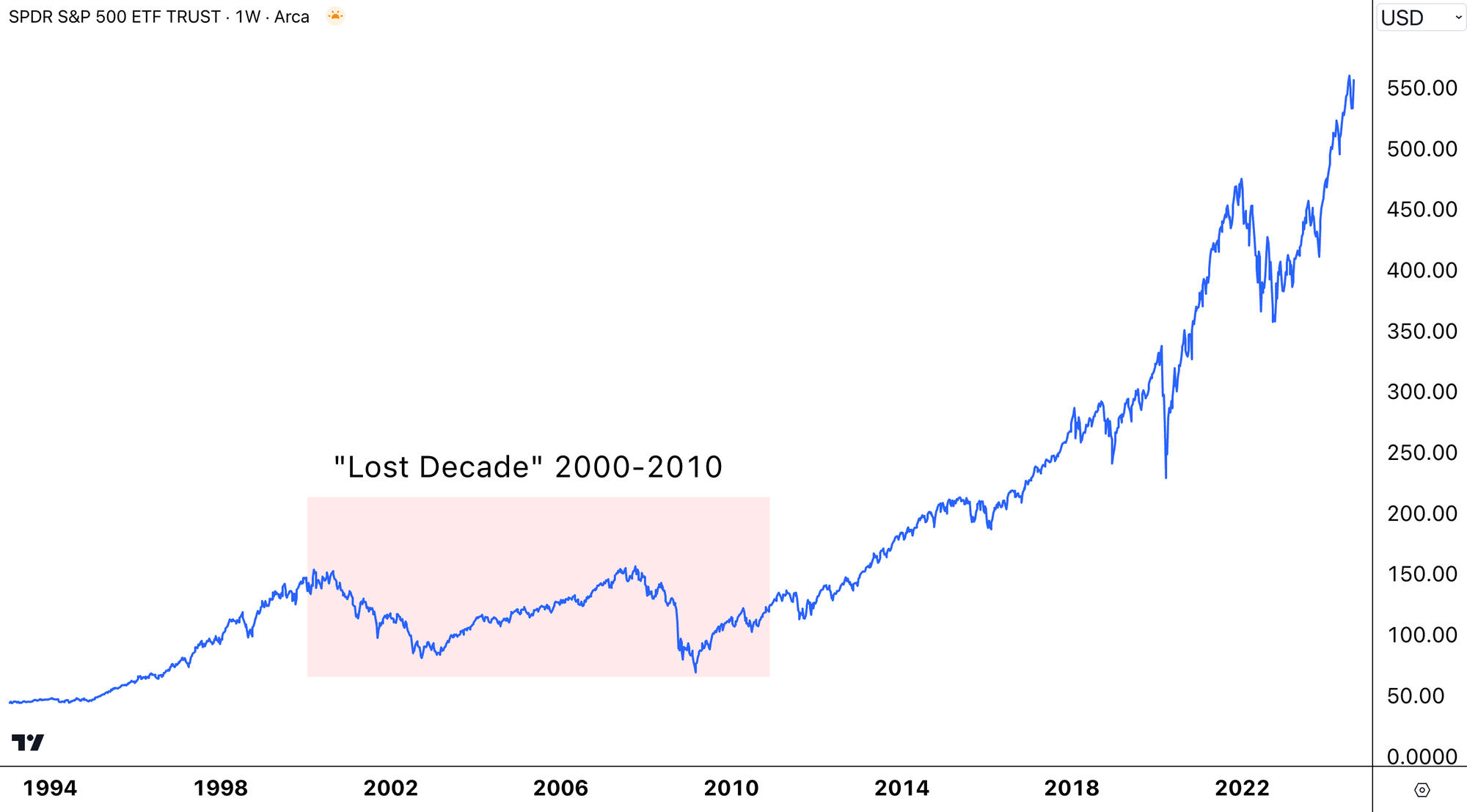

Let's look at a price chart for the SPY over the last 30 years. This long perspective shows the challenge with buy and hold. There is a period from 2000 until 2010 and beyond where the SPY price did a lot of up and down but didn't get anywhere. In that period the markets and the economies were hit twice. By the burst of the Dot-Com bubble in 2000 and the Global Financial Crisis in 2008. I think it was either the Wall Street Journal or Bloomberg who coined the name "The Lost Decade".

Clearly a weakness of the "Buy and Hold" strategy is there might long periods with negative returns.

But what about if I need my money in 10 years?

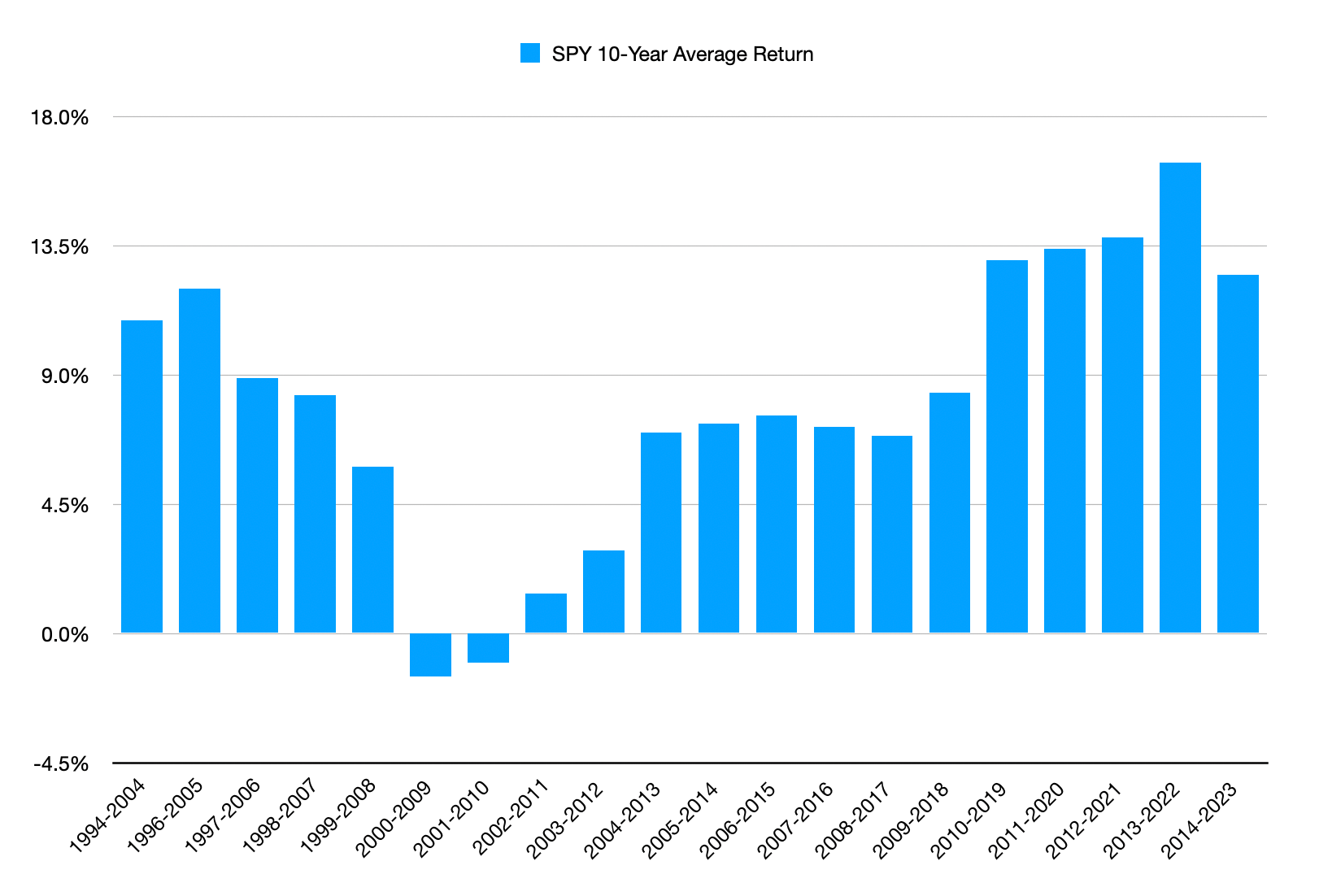

Let's look at 10 year periods. As you can see the 10 year average performances for the SPY has quite some variation. From 2000 until end of 2009 the average return was -1.5% and from 2013 until end of 2022 it was 16.4%. Both of these numbers are average annual performance over 10 years.

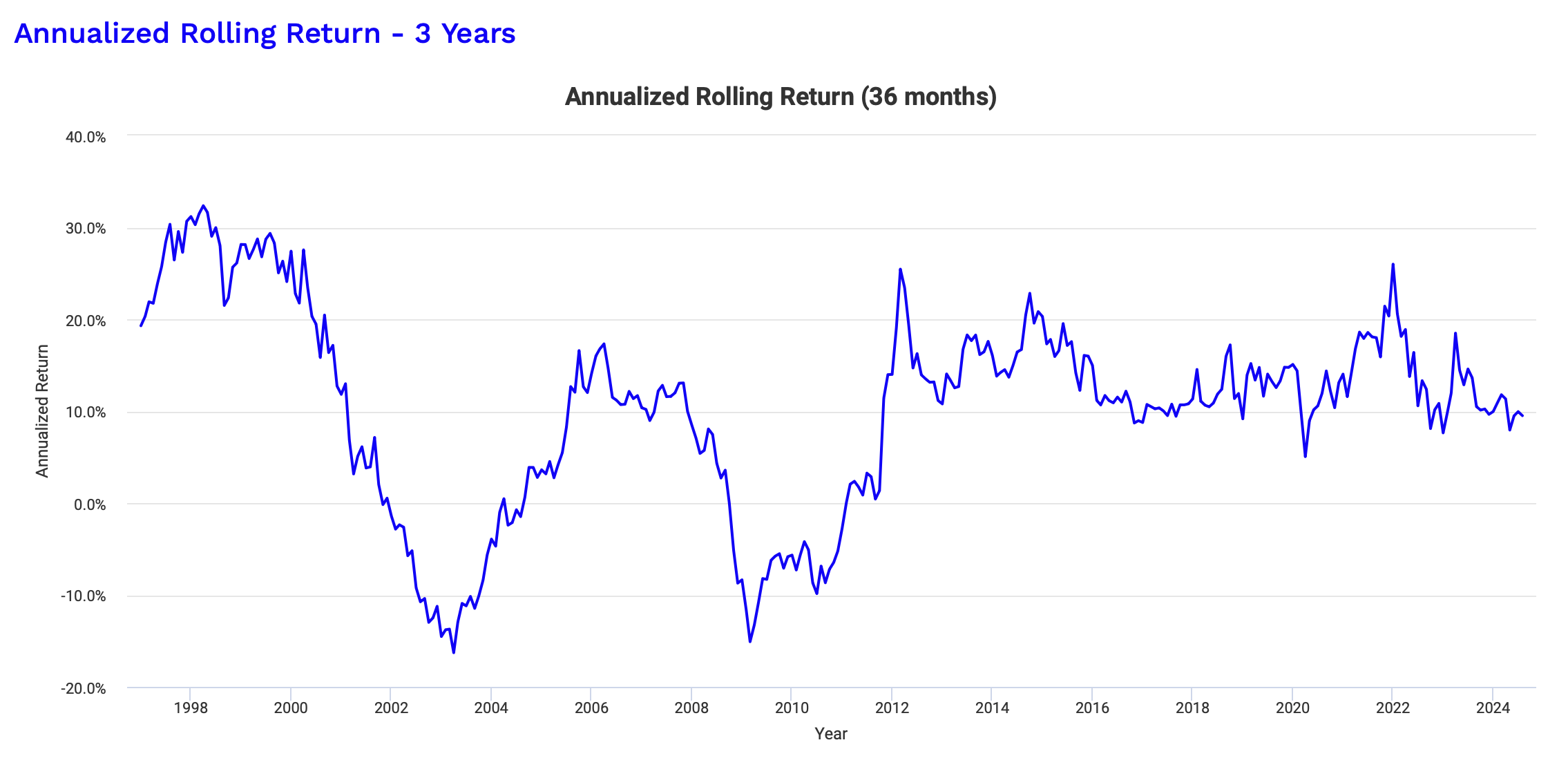

And if we look at shorter periods like 3 years for example it becomes clear we had several 3 year periods with negative returns. This graph shows averages for 3 years periods since 1997. We can see how the two major market crashes the Dot-Com bubble in 2000 and the Global Financial Crisis in 2008 made an impact.

So - Is "Buy and Hold" any good?

We can see that "Buy and Hold SPY" for the last 30 years has been a good investment strategy on AVERAGE and anyone who is at least 30 years away from the time where you need to access your portfolio and take money out, than could be a simple and effective way to invest. But we need to accept that there is volatility. Volatility is not a problem if you dont have to sell because you need your money. If you can continue holding you might be just fine. At least you have been over the last 30 years.

Is that all? No. That's just the beginning. There are several aspect we did not analyze. One of them - what happens when we save monthly and then invest the savings into SPY every month? This kind of monthly investing into SPY can be very powerful and changes everything! It does something called "Dollar Cost Averaging" and will be covered in our next post "Buy and Hold boosted by DCA".

Please share this with a friend you think might benefit from this. Place a comment if you want us to write about a specific topic or want us to research a particular question. After all you are all friends and family! Literally !