Who Wants to Be a Millionaire?

How easy is it to gain financial independence? When you start early it can be very easy! Testing a SPY Investment Savings Plan with a 40 year Monte Carlo simulation.

A couple of years back I spent some time with my nephew Mo in Las Vegas. Back then he was 16 and inspired by all the glitz he asked me how he could become wealthy. "That's easy" I said, opened up my computer and build him a spreadsheet showing the power of compounding equity returns. Fast forward - earlier this year he turned 18, started his career as a cook and invested his first $100 into a monthly SPY ETF savings plan. Fantastic Mo! Well done! You got this!

What results can you expect?

In finance we have a crystal ball called Monte Carlo simulation. It is a tool to take the lessons learned from the past and simulate the future in order to get a view about risks and opportunities.

Let's test Mo's SPY investment savings plan with the Monte Carlo machine and check how much money he will have when he turns 58 in 40 years. This is considered an early retirement.

Today, Mo is saving $100 a month - $1200 per year and he plans to increase his amount by 15% yearly. This is an ambitious plan, but he wants to achieve a certain degree of financial independence as soon as possible. All dividends he receives will be re-invested.

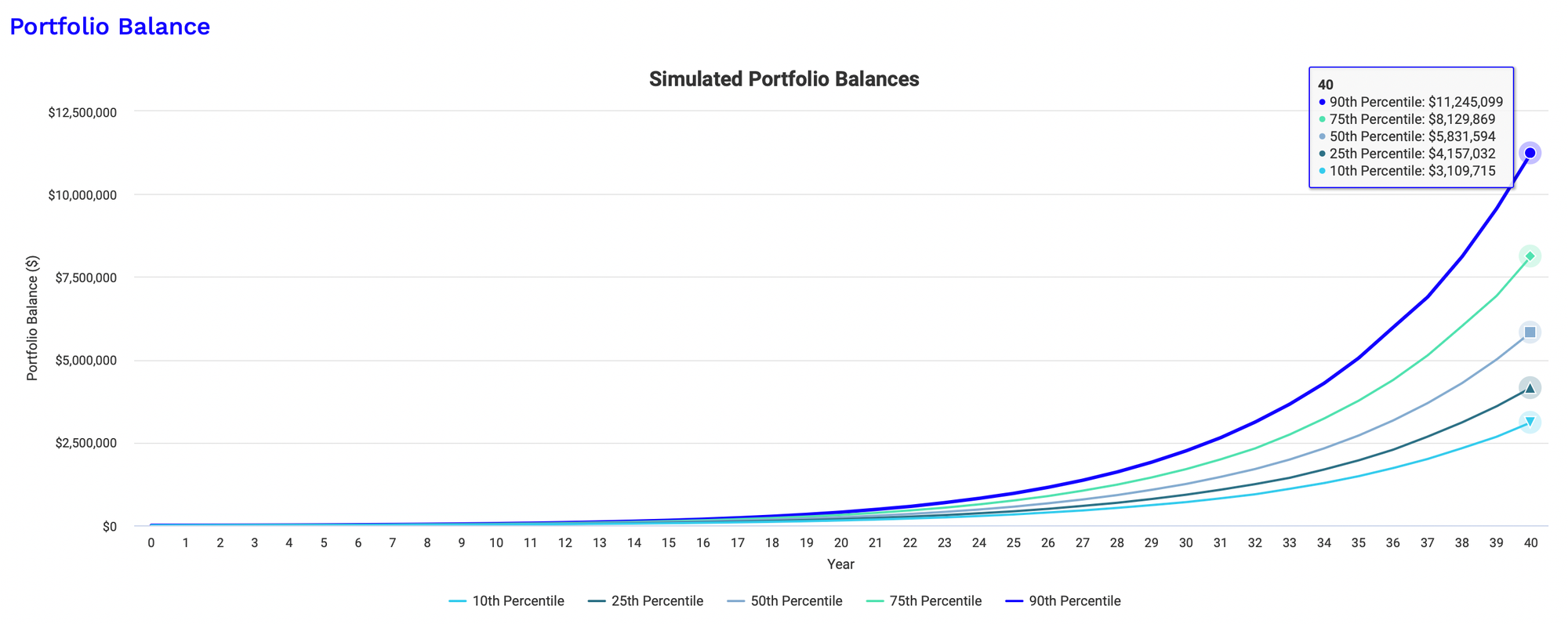

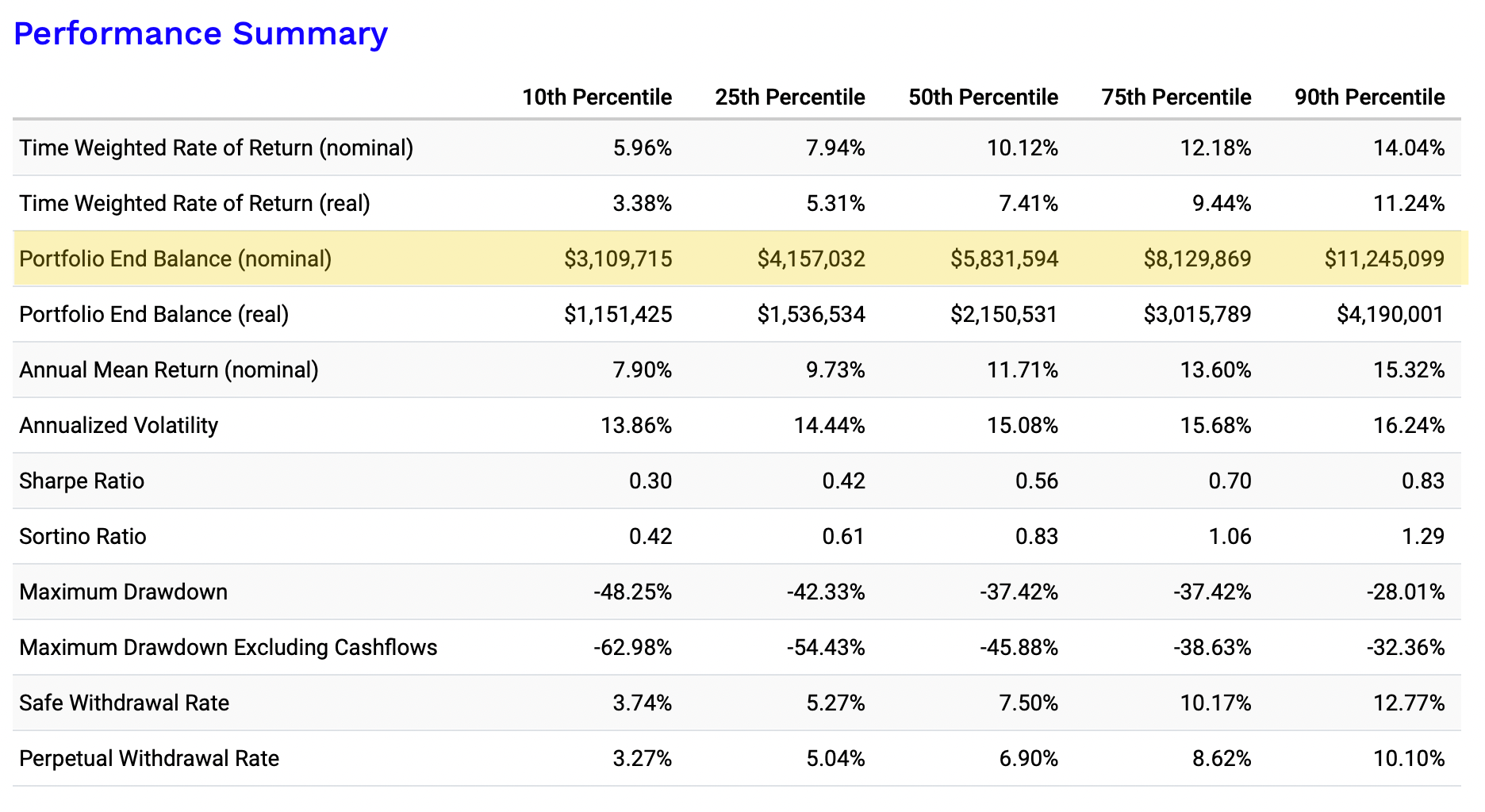

Let's do a Monte Carlo simulation for the next 40 years and look at the future portfolio values. In this simulation, we ran 10,000 possible outcomes for Mo's portfolio value. The graph shows five different lines, called percentile lines, which represent different possible portfolio values over time and their associated probabilities.

The performance summary table makes it easier to see the values. You see a column for the 10th, 25th, 50th, 75th and 90th percentiles. What kind of gibberish is that?

Okay! Let’s make it easy for everyone to understand.

Looking at the 10th percentile column we see a "Portfolio End Balance (nominal)" of $3.1 million. You can read it like this: There’s a 90% chance that the portfolio value in 40 years is more than $3.1 million. Or you could say there is only a 10% chance the portfolio value in 40 years is below $3.1 million.

We can also say that there’s an 80% chance (that is the range between the 10th and 90th percentile) that the portfolio value will land somewhere between $3.1 million and $11.2 million.

Within this wide range of possible outcomes, Mo can expect that his portfolio value will be around $5.8 million. This represents the average result, meaning there is a 50% chance that the portfolio will be above or below this amount. It’s a useful way to set expectations, giving Mo an idea of where his portfolio might end up in average.

Looking at the stars! There is even a small chance of around 10% that the portfolio exceeds $11.2 million! That would be a nice booster rocket!

90% Probability - Mo will be a Millionaire

Based on our assumptions from above, Mo will most likely end up with a savings account between $3.1 and $11.1 and an expected value of $5.8 million.

There are many issues with long term simulations. One of them is inflation. This Monte Carlo simulation takes inflation into account and calculates the "real" portfolio end balances.

The expected value of $5.8 million in 4o years time will be equivalent to $2.1 million in today's buying power, ie adjusted for inflation.

What we learn from this simulation is that Mo's monthly SPY savings will have a substantial value in almost every scenario in 40 years. The probability Mo will be a millionaire is above 90% even adjusted for inflation.

What about bonds?

But does it really make sense to invest only in SPY? Someone told me bonds are safer than stocks, they pay fixed interest payment and I get my money back. That's a good question. Let's test it!

There are almost 4,000 ETFs we can choose from in addition to SPY which is the most popular equity ETF. In future posts we will dive into the world of ETFs and we will learn more about them. For now let's assume you want to mix the SPY with another ETF called BND.

The BND ETF, also known as the Vanguard Total Bond Market ETF, invests in U.S. investment-grade bonds. It includes a mix of various bond types. This ETF is often used by investors to balance their portfolios with a stable income-generating asset. This sounds not bad. But is it helping Mo in the long run?

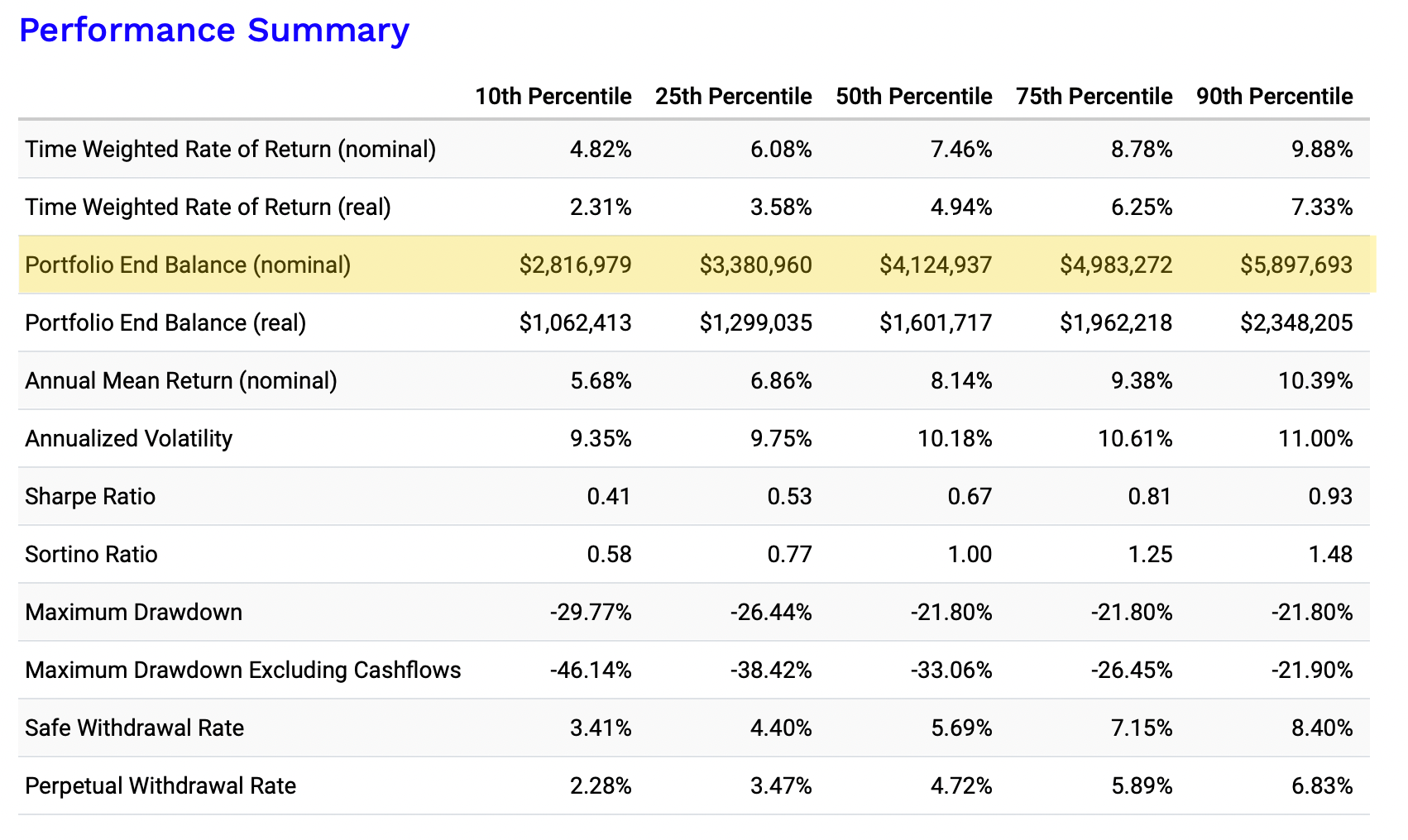

Let's look at the results for the scenario where Mo splits his monthly investment in 50% SPY and 50% BND:

Now there’s an 80% chance that the new 50/50 portfolio will land somewhere between $2.8 and $5.8 million with an expected value of $4.1 million.

I can hear Mo ... Hold on!! Why? Why would I do that. Where is my booster rocket? With the 100% SPY there was a chance of 80% to be between $3.1 million and $11.2 million and a 10% chance to have even more that $11.2 million. Now I have significantly less of an 'upside'. No way! I stay with SPY.

When it comes to long term investing for a 40 year period I agree with Mo. You want to have your booster rocket in the form of SPY or similar diversified equity ETFs for several reasons.

I hear it! Someone said Crypto! 🚀 I want a crypto booster rocket! 🫣 😀 We will talk about crypto for sure, but not today!

Light the FIRE

Speaking of igniting the booster rocket. If you have not heard about the FIRE movement, now is the perfect time to introduce you to Brad Barrett and Jonathan Mendonsa.

Brad and Jonathan became key figures in the Financial Independence, Retire Early (FIRE) movement. They co-founded the popular website and podcast “ChooseFI” with plenty of resources how to increase your savings rates and reach a degree of financial independence. You can also follow Jonathan on WeathFit.

One goal of the FIRE movement is to reach a "Crossover Point" where your income from investments exceed your cost of living. At that point you could potentially quit your job if you want to. There is Lean FIRE and Fat FIRE. Lean FIRE people are super frugal and save 50-70% of their income and the Fat FIRE guys are not pushing it so hard with saving rates of 30-50% of their income.

The core FIRE message is that the more you are willing to put into your savings the higher the chances are, that you reach your "Crossover Point" sooner. Once you reached that point you truly can do more of what you love to do. That might be your job or something else. The choice is yours to make!

Conclusion

The power of an investment savings plan, when started early are often underestimated and can make a big difference when it comes to retirement. Many countries have tax incentives for that reason. I can only recommend all the parents and grandparents out there to set up saving plans early and teach their kids how to build their own retirement plan.

This is our fifth post and we covered already some very important investment topics.

- The Buy and Hold Benchmark

- The Power of Dollar Cost Averaging

- Volatility & Sharpe Ratio

- Active Investment Strategy I: The Moving Average Strategy

- Monte Carlo Simulations

Since we have some fundamental topics out of the way, the next couple of posts we will look into the universe of ETFs, compare them to our benchmark and test if we can increase the Sharpe Ratio. Remember Sharpe Ratio? Wow ... you are good! You are very good!

Until next week!