How to Test Your Investment Strategy?

Tools to develop and test your investment strategy.

Let’s start with some wisdom from Solon, a renowned statesman in ancient Athens, Greece (c. 630–560 BCE), who said: “Seek no master other than yourself.” Solon’s reflection on personal responsibility and the value of self-governance is still relevant today, especially when it comes to investing. It’s your money and you’ve worked hard for it, so it makes sense to approach investing with self-reliance, knowledge and confidence. After all, you’re the best steward of your wealth, and over time, you’ve learned a lot!

You Already Know So Much!

By now, you understand many of the fundamental concepts that shape successful investing. You know about the SPY buy-and-hold benchmark, a reference strategy many use to measure performance over time. You’re familiar with dollar-cost averaging and how it can reduce risk by spreading out investments. You’ve learned about the significance of volatility—how it can create both opportunity and risk—and you’ve seen how certain strategies, like moving averages, have outperformed SPY buy-and-hold during specific periods.

Your knowledge isn’t limited to a handful of ideas. You’re aware of how vast the world of ETFs is and have insights into selecting a broker who can offer access to the right markets, low fees, and solid support. You understand the dangers of making quick exit decisions during downturns because you know that missing even a handful of the best-performing days can severely impact long-term returns. In fact, you know a whole lot! You’ve gathered, retained, and internalized so many pieces of investing wisdom, and it’s worth celebrating! 👏🏼👏🏼👏🏼 When you know, you know!

The Power of Knowledge

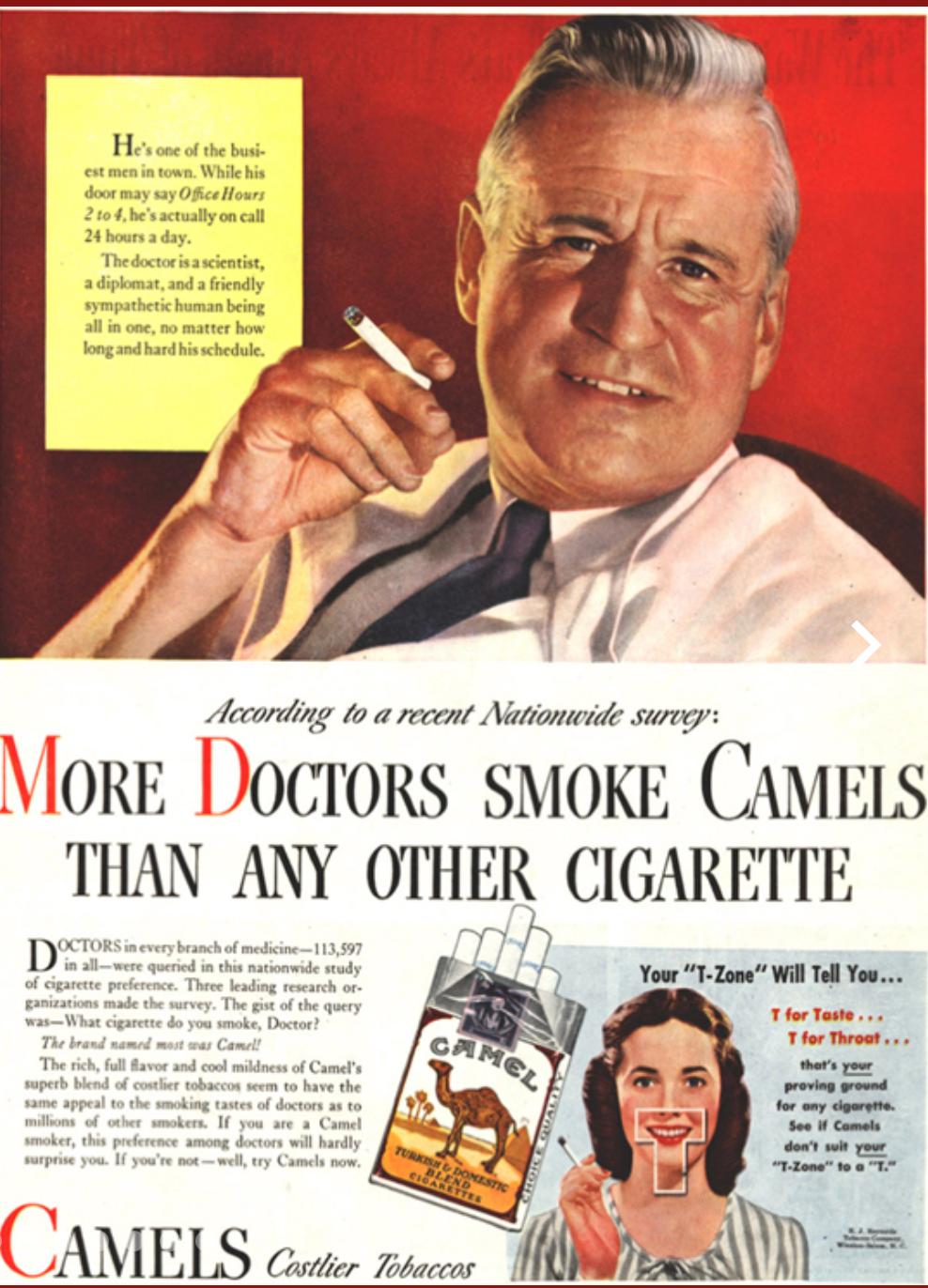

Knowledge is powerful, but applying it thoughtfully is essential for building solid, adaptable investment strategies. In this process, tools and verification become critical. Sure, you can pick up ideas from financial news, blogs, or YouTube videos that seem promising. Still, with so many opinions out there, you want to verify the claims and test the ideas that resonate with you. Investing is full of claims, often from well-meaning professionals, but sometimes from those who want to persuade you without disclosing the whole truth. Remember the old tobacco campaigns?

How can more than 100,000 doctors be wrong?

Back in 1946, Camel cigarettes famously claimed that “More Doctors Smoke Camels than any other cigarette.” The campaign featured doctors confidently holding cigarettes, suggesting that smoking was safe, even beneficial. This bold advertising was based on a survey of more than 113,000 physicians, but the truth behind it was questionable. Physicians were often offered free cigarettes before indicating their brand preference, skewing the results. This tactic created a misleading perception of safety around smoking, playing on the public’s trust in medical professionals.

Decades later, in 1998, the Master Settlement Agreement held tobacco companies financially accountable for public health costs associated with smoking. The industry was ordered to pay $206 billion, a historic settlement, to help cover the consequences of smoking-related illnesses and to limit future advertising practices.

When it comes to investing, the world is full of claims about how to make money or secure financial success. While some professionals are honest, not everyone is sharing unbiased truths. Much like the tobacco industry, some investment advice could be “puffery”—convincing but not entirely transparent. However, you’re far too savvy to blindly follow someone’s formula without scrutiny. Sure, you may think, “How can more than 100,000 experts be wrong?” 😀 But history shows us that even popular advice can be flawed. The takeaway? Be inspired by good ideas, but verify them through your own testing and analysis. Inspiration is great, but verification is essential!

What is in your toolbox?

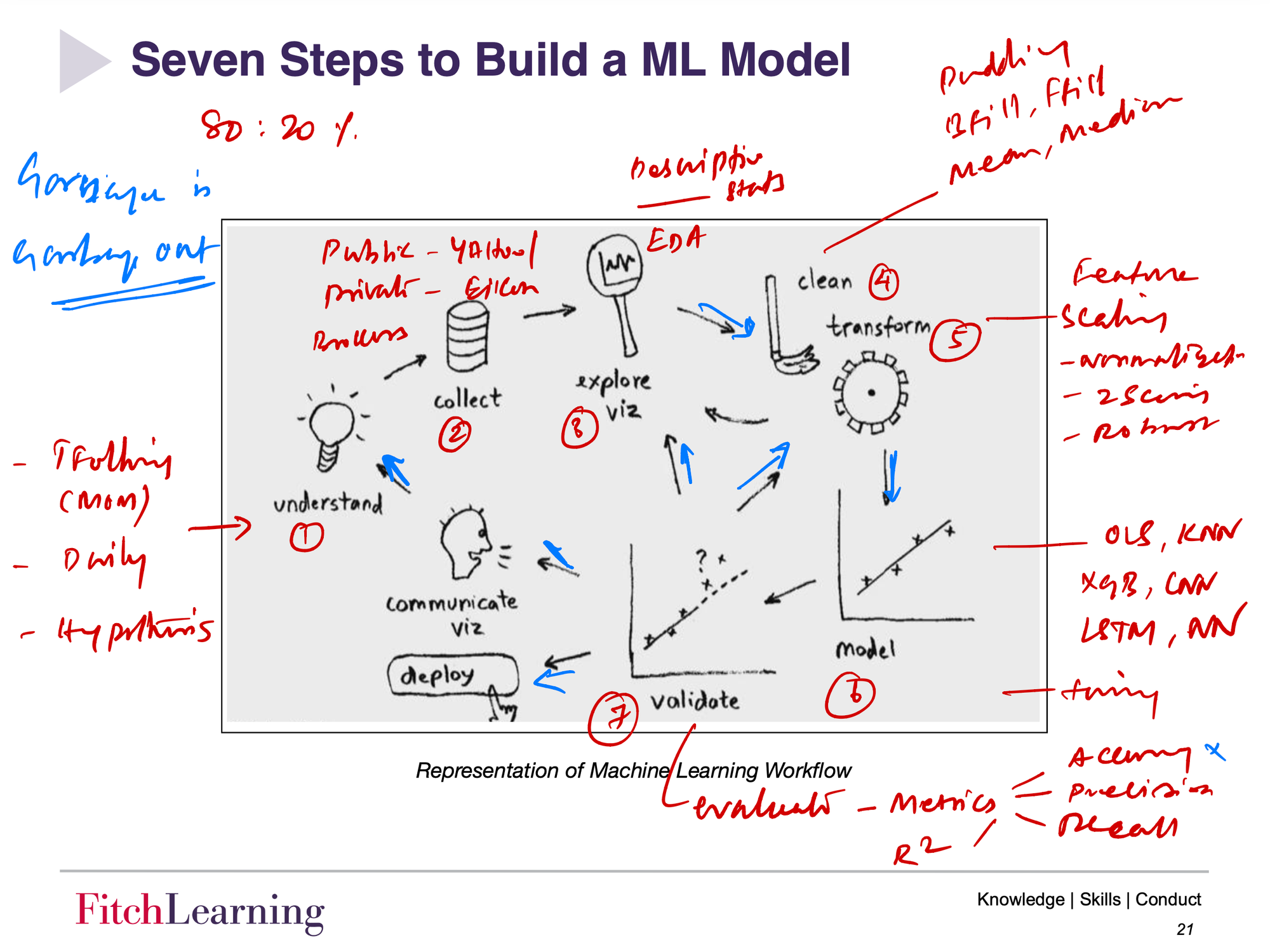

Developing a sound investment or trading strategy can be as simple or complex as you choose. Let’s break it down into fundamental building blocks that make the process manageable. Let's use the seven steps of building a machine learning model from the Certificate of Quantitative Finance course, we’ll simplify the process for practical investing.

This five-step model isn’t only valuable for institutional investors; it’s perfectly suited for individual investors who want a systematic approach. Here’s a breakdown:

Step 1: Idea: Start with a concept—maybe following market trends or identifying undervalued assets. Define what triggers a buy or sell in your strategy.

Step 2: Visualization: Plot and inspect patterns to see if your idea aligns with historical data.

Step 3: Backtest: Run the strategy against past data to analyze performance.

Step 4: Validation: Confirm that your strategy isn’t just a fluke by testing it across different conditions.

Step 5: Deployment: Go live with “paper money” first, then transition to real capital as confidence builds.

These five steps are interconnected. Sometimes, you may need to revisit earlier steps to refine your hypothesis or adjust your approach based on new insights.

Step 1 - Idea

Every investment strategy starts with an idea. This could be as simple as buying stocks that look undervalued or capitalizing on trends in the market. The idea phase involves identifying what drives your strategy—whether it’s following a market trend, rebalancing periodically, or identifying specific triggers to buy or sell.

Tools

YouTube is a good place to begin, as it offers insights from a range of investors. Quantpedia and Quantopian are also valuable for exploring quant-based ideas.

Examples

YouTube - Moving Average

Quantpedia - Momentum Asset Allocation Strategy

Quantopian - Theory to Practice: Moving Averages and the Magnificent7

Step 2 - Visualization

Visualizing your ideas helps reveal patterns and potential flaws. Through charts and visual analysis, you can observe how your indicators align with historical trends. This process can confirm (or disprove) initial assumptions and build confidence in the strategy.

Tools

TradingView, Google Sheets and Excel are widely accessible for creating basic charts. For more detailed visualization, Python with libraries like Matplotlib in Jupyter Notebooks allows for deeper analysis.

Examples

Python/Jupyter Notebooks - Matplotlib

Step 3 - Backtest

Backtesting allows you to assess how the strategy would have performed historically. By running your strategy against past data, you can uncover both strengths and weaknesses. If your backtest results are promising, you’ll have a stronger foundation to move toward validation.

Tools

The QuantConnect platform and the python library backtrader are specifically built for backtesting. Python with Yahoo Finance or Alpha Vantage APIs allows flexible data import and analysis.

Examples

Google Sheets - Test a simple moving average strategy (more explanation)

Python - Pandas and NumPy

Python and Backtrader - Creating and Backtesting Trading Strategies with Backtrader

QuantConnect - Moving Average Strategy

Python with Yahoo Finance - Python for Finance, Part I: Yahoo & Google Finance API, pandas, and matplotlib

Step 4 - Validation

Validation helps confirm that your strategy’s success is repeatable rather than due to chance. By testing in different market environments or with varying datasets, you can ensure that the strategy holds up across multiple scenarios. A reliable strategy that performs consistently in varied conditions is ready for real-world application.

Tools

QuantConnect is a powerful tool for validation, while Python with its libraries and diverse datasets (such as EODHD or Alpha Vantage) allows for extensive testing.

Examples

Step 5 - Deployment

Once validated, it’s time to deploy your strategy, initially with “paper money” to monitor real-time performance without real financial risk. Paper trading provides a chance to see if the strategy performs in line with backtest and validation results. As confidence grows, the strategy can be adjusted for live trading, ensuring it aligns with initial insights and test outcomes.

Tools

Broker platforms connected to QuantConnect or QuantRocket enable live execution and monitoring. Python remains valuable for ongoing analysis and adjustment.

Examples

Summary

Building and testing your investment strategies requires practical tools and a thoughtful approach. With today’s advancements in AI and platforms like ChatGPT, learning and using these tools has become more accessible. Join us on this journey as we explore powerful tools like Python, Jupyter Notebooks, and QuantConnect to develop robust, data-driven trading strategies.

✅ Python

✅ Jupyter Notebooks

✅ QuantConnect