Boosted Buy and Hold

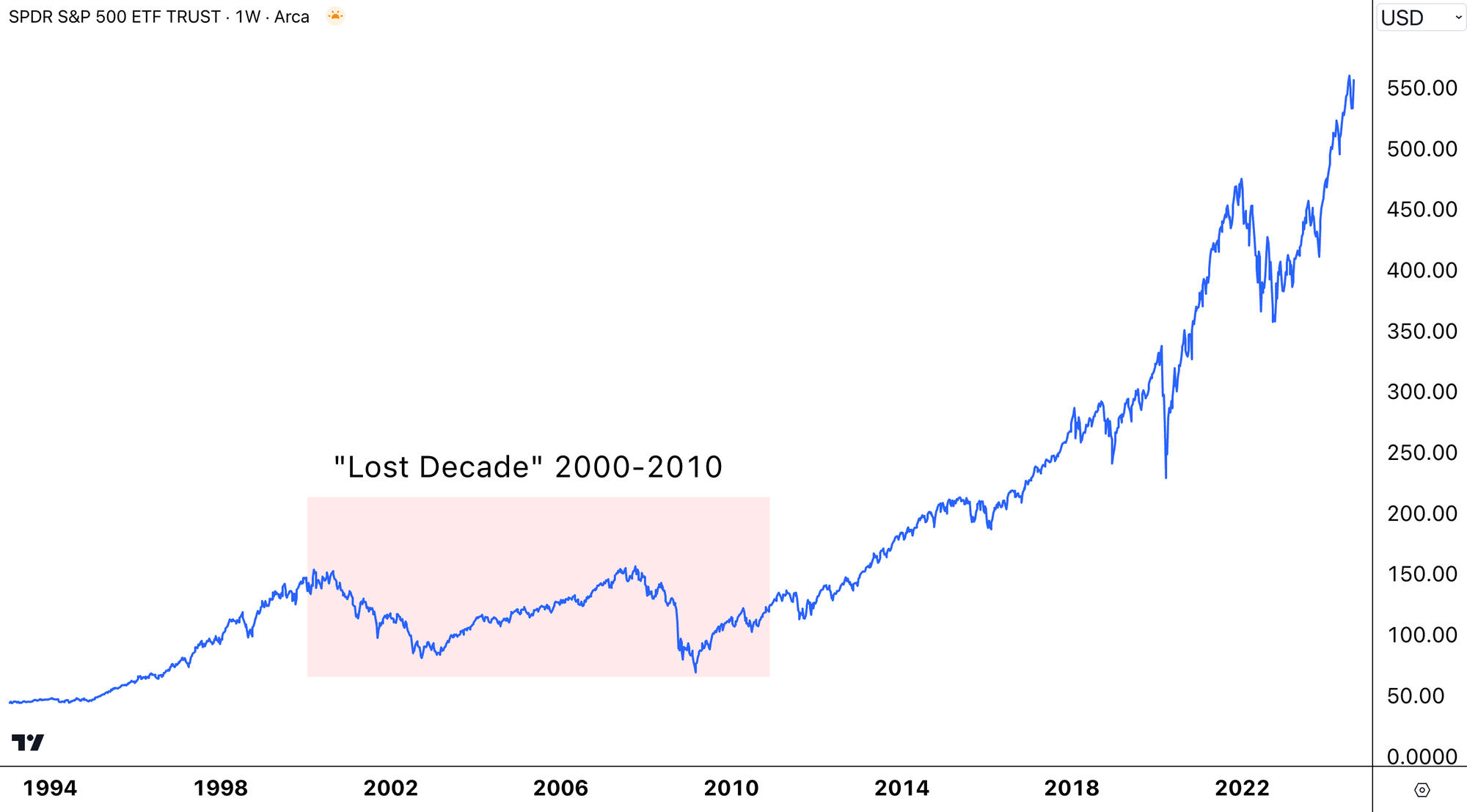

Buy and Hold is a simple investment strategy. But in a period like the 'Lost Decade" did not perform very well. Dollar Cost Averaging can help smoothing our performance by saving every month a small amount and therefore benefit from lower prices when prices go down.

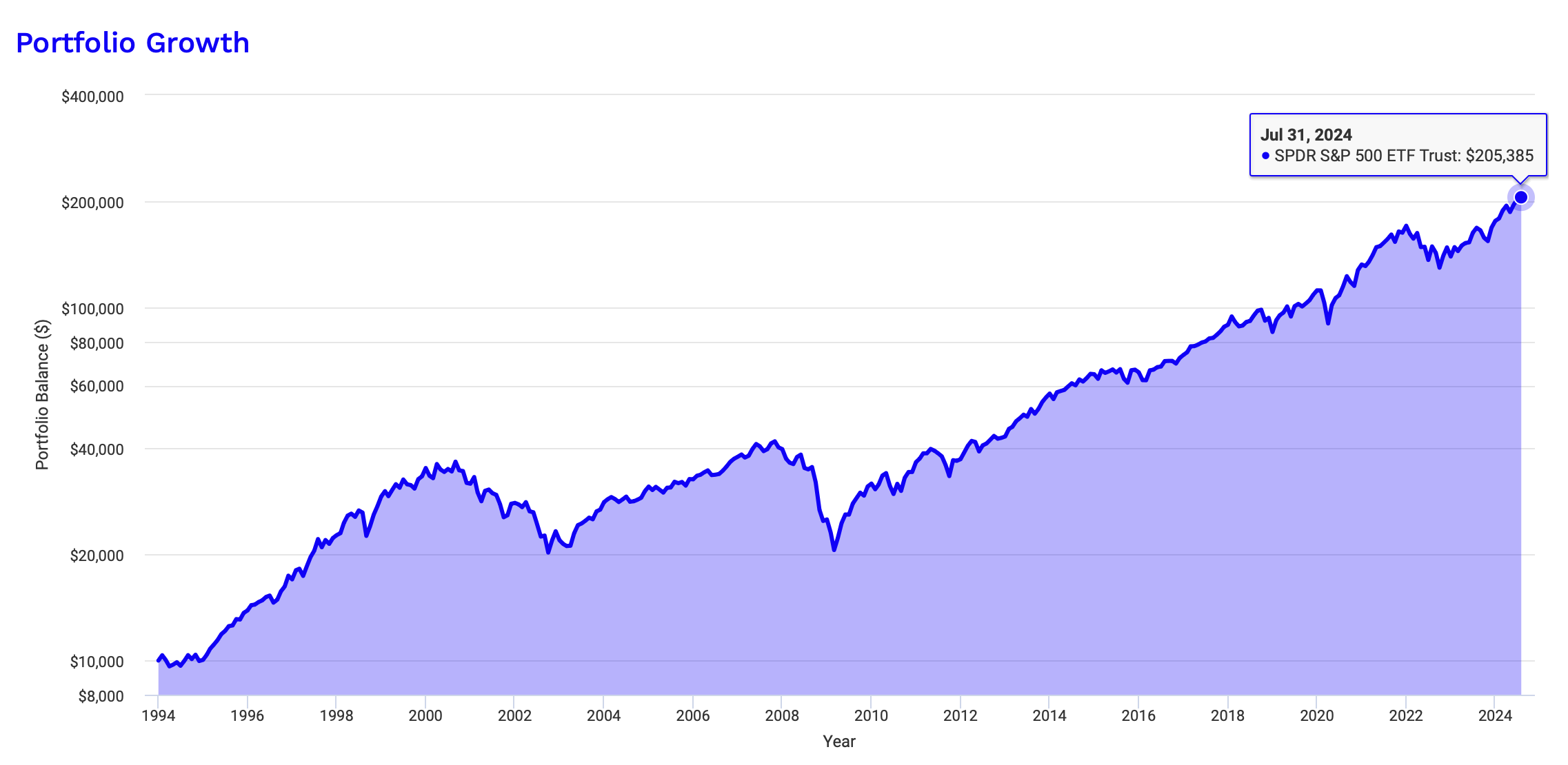

In the first post Let's talk about "Buy and Hold" we understood by holding the SPY ETF since 1994 our money made us an impressive 10.4% average annual return and our $10,000 investment grew to $205,385 by July 2024.

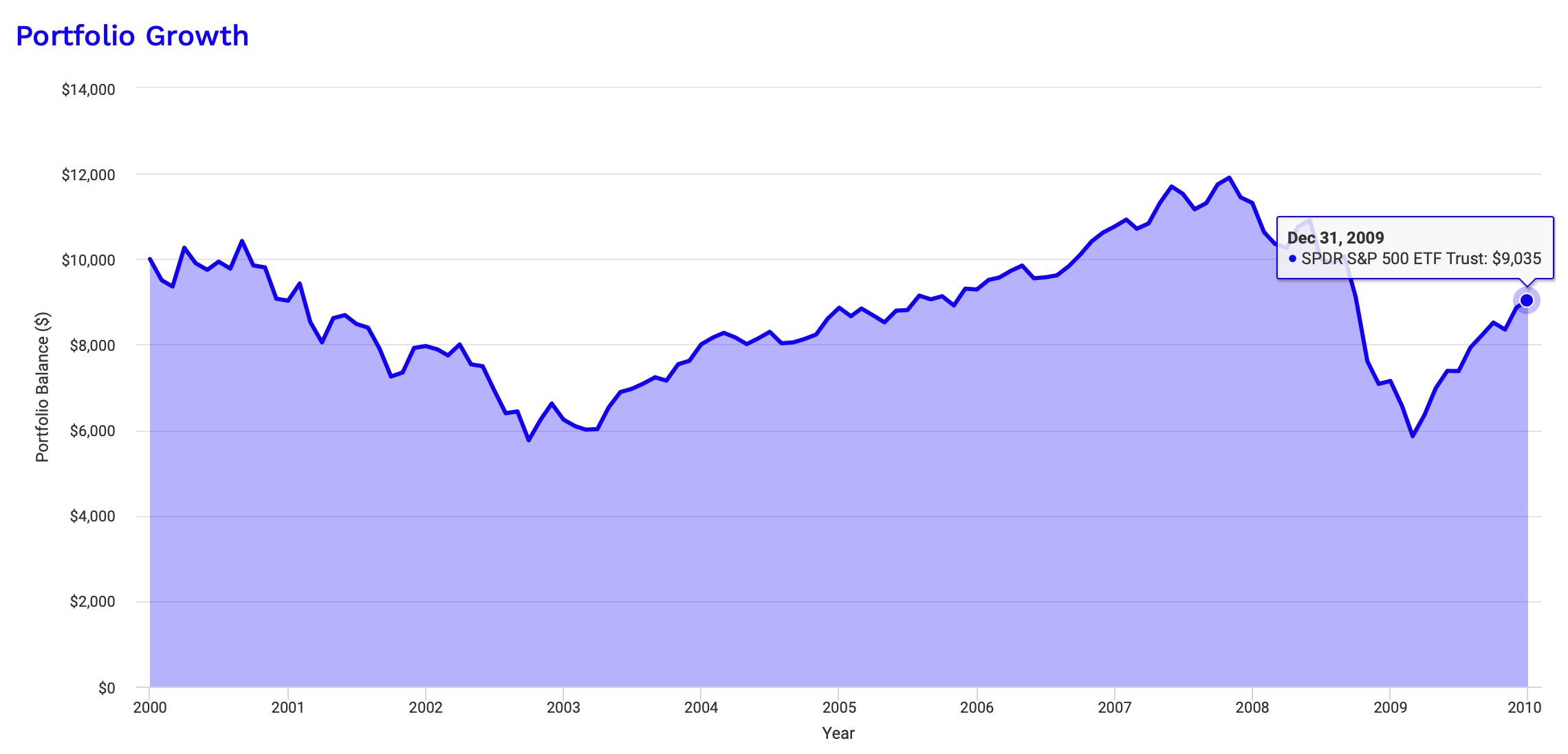

But we also learned about the catch of buy and hold. The "Lost Decade" was a bit of a dry period for our 'buy and hold' strategy. In that period from 2000 until the end of 2009 our investment lost an average annual return of -1% if we would have started investing in 2000.

Our money worked hard for 10 years, even made money is some years, but overall nothing to show for. We lost 10% in total. Remember the basic math. An average annual return of -1% over 10 years adds up to -10%. Not good! Our $10,000 in January 2000 decreased to $9,035 at the end of 2009.

Can DCA rescue Buy and Hold?

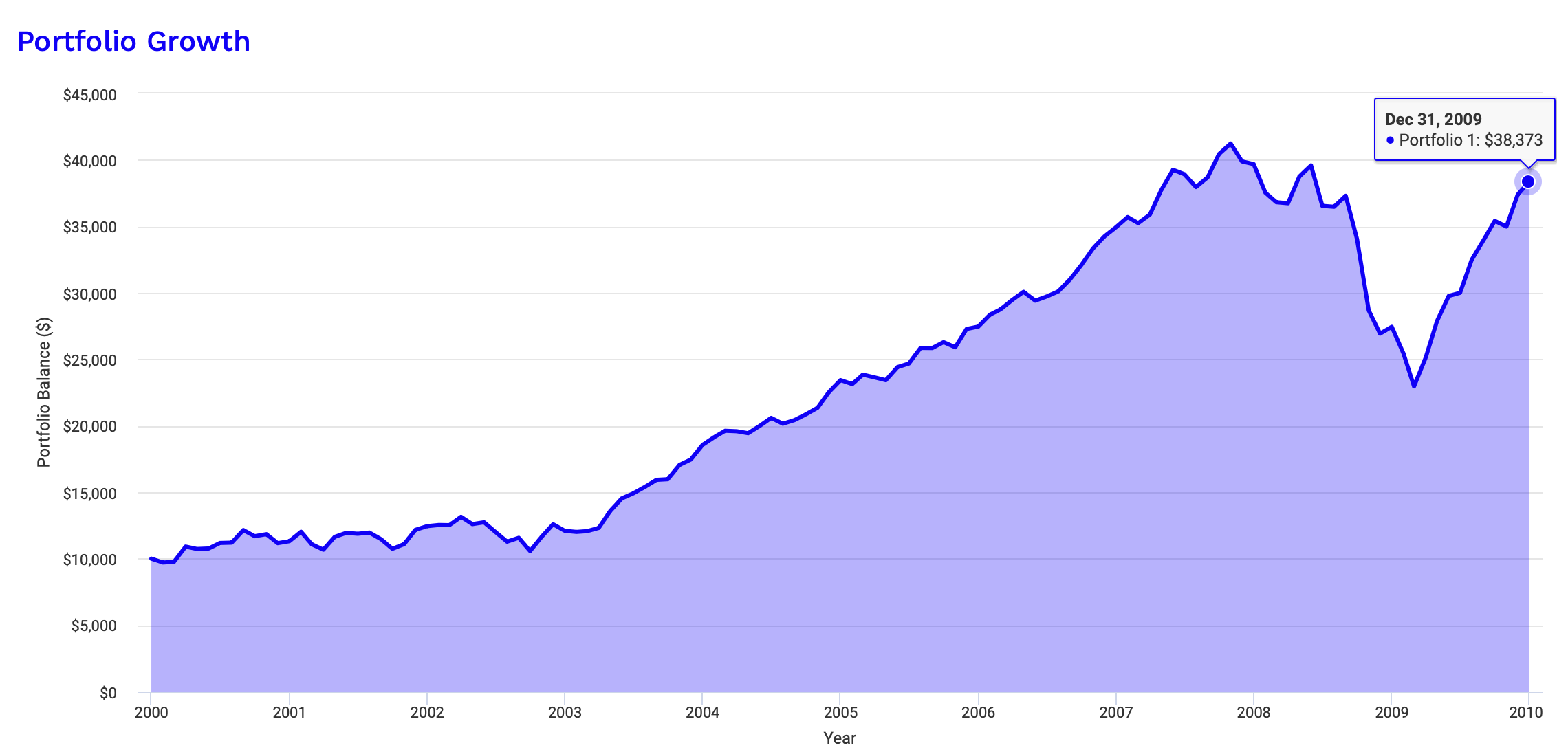

DCA stands for Dollar Cost Averaging. It's a convoluted way to say monthly savings will save us in the "Lost Decade" scenario. Basically if we save a certain $ amount every month and buy SPY ETFs in addition to our initial investment we benefit from the fact that when the prices go down, we get more SPY ETFs for our money and make good returns in the recovery. That way we avoid betting on a single point in time where we invest all our savings. Our DCA rule is very simple. In addition to our initial investment we save money monthly and invest monthly. Let's put this to the test for the tough period of the "Lost Decade"! By the way, these test we are doing with the "Portfolio Growth" charts is a simple form of backtests which we will use more and more going forward.

In our backtest we start with $10,000 in January 2000 and every month we save $200 and buy ETFs for that. We will look into the technicalities of this in a future post, because there is technology out there where you can automate this kind of monthly investments.

By the end of 2009 our portfolio grew to $38,873 with our $200 monthly SPY savings compared to $9,035 without $200 monthly savings. Now this is a big difference in absolute value and it highlights that saving and investing is key when building wealth.

Let's look into the details. Actually the SPY price appreciation did not help much. Because if we do the simple math by adding up all cash amounts we get to $34,000 which is $10,000 initial investment plus $200 times 12 months times 10 years ($24,000 = 200 x 12 x 10). But still we made $4,373 more than just keeping cash. And yes! We will also talk about inflation soon.

Buy and Hold plus DCA over 30 years

How about "Buy and Hold" with or without DCA over a longer period?

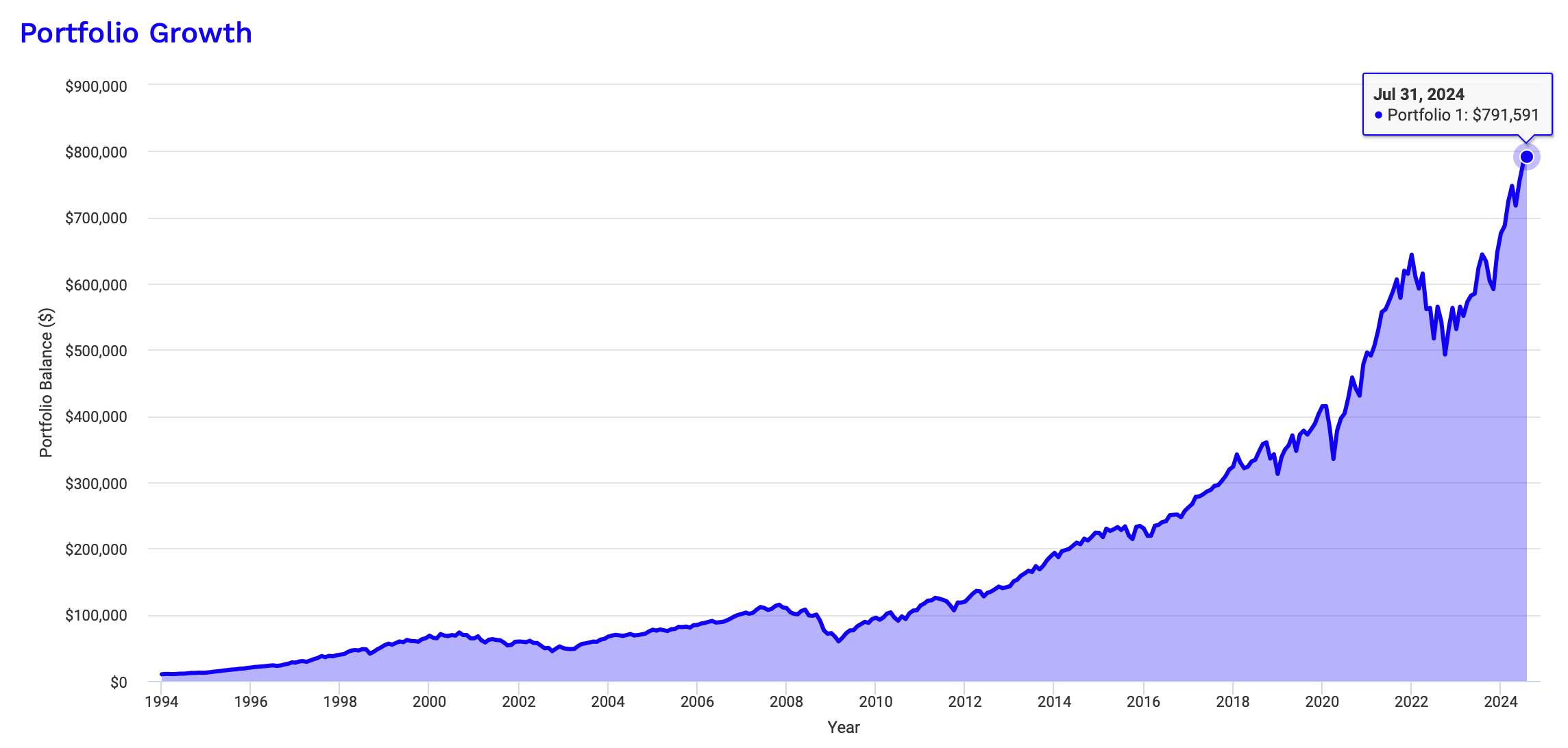

Our $10,000 invested in 1994 grew to $205,385 by July 2024. How would this change with only $200 savings put into the SPY monthly? Our portfolio value would have grown to $791,592 in the same time period. In terms of average annual portfolio return we just increased it from 10.4% average annual return (simple Buy and Hold) to 15.4% average annual return with $200 a month.

Growing $10,000 initial investment and $200 monthly savings into $791,591 is not a small thing. One of the simple but powerful truths how to build wealth.

If you ask AI about the relevance of DCA you will get something like this:

Dollar Cost Averaging (DCA) is a powerful investment strategy that involves regularly investing a fixed amount of money into a particular asset, regardless of its price. This approach is particularly relevant in volatile markets, as it allows investors to spread their investment over time, reducing the impact of market fluctuations. By consistently buying more shares when prices are low and fewer when prices are high, DCA helps to lower the average cost per share, potentially leading to better returns in the long run. This strategy also promotes disciplined investing, mitigating the emotional impact of market highs and lows, and encouraging a long-term perspective on wealth building.

After seeing the charts of the backtest results I think we can all agree.

Our first Promotion - Congratulation!

This is the second post and we already get a promotion! Because we just defined our first investment strategy! We can officially put Baby Portfolio Manager on our business card!

Here is our strategy:

"In addition to our initial $10,000 SPY investment we buy every first workday of the month SPY ETFs for $200 - rain or sunshine."

But it gets even better. This is not just our first strategy. It is our first algorithmic strategy. Another promotion? Yes! Our business card reads now Baby Algorithmic Portfolio Manager.

Joking aside - why is that so important?

When we formulate your investment strategy into an algorithm we make it objective. There is no gut feel. No fear nor greed. It is a strategy you can backtest and you can tell a computer to execute it. This is the only way!! Later we will see there is space for intuition and creativity in developing complex strategies, but the result is always an objective investment strategy which can be formulated as an algorithm.

Since we have our first investment strategy we can ask ourselves "What if I have $X and in addition I can save $X every month for the next X years and what if I invest this in the XXX ETF". How much money do I have when I retire? How long will that last?"

This is a complex question, but one of the most relevant questions we have to ask ourselves as Baby Algorithmic Portfolio Managers.

Until next week where we try to answer this.

Please share this with a friend you think might benefit from this. Place a comment if you want us to write about a specific topic or want us to research a particular question. After all you are all friends and family! Literally !