Beyond the Risk Floor: Exploring the Opposite Side of Risk

Last week, we explored the Risk Floor, a safety net for worst-case scenarios. Today, we introduce the Blue Sky Potential—the upside counterpart. Together, they help you balance risk and reward for smarter, more confident investing.

Last week, we introduced the concept of the Risk Floor, which represents the worst 2.5% of outcomes in a Monte Carlo simulation—a tool for quantifying the worst-case scenario in investing. This number helps investors understand the potential downside risk of a particular investment.

For instance, consider an investment with 50% annual volatility and an initial value of $10,000. A Risk Floor calculation might reveal that, after one year, the value could drop to $3,500 in the worst 2.5% of scenarios. While this is useful information, focusing solely on the downside tells only half the story. One of you reached out and asked last week in response to the How Much Risk is Too Much for Me?: “What about the upside?” Great question!

This week, we’ll explore the opposite end of the spectrum—the Blue Sky Potential—and examine how it complements the Risk Floor to provide a more balanced perspective on investment strategies.

What is the 'Risk Floor' again?

The Risk Floor is a number representing a kind of safety net, offering insight into how far an investment could fall under poor market conditions, given its volatility. By running Monte Carlo simulations that focus on worst-case outcomes.

For example, imagine a $10,000 investment in a stock. A Risk Floor analysis might show that in the worst 2.5% of simulated scenarios, the value could drop to $6,000 after one year. This gives investors a clearer picture of potential losses during extreme market events, helping them prepare both psychologically and financially. But how about the potential gains? Is there something like the best 2.5% of simulated scenarios? Sure there is!

The Blue Sky Potential

While the Risk Floor represents the lowest likely outcome, the Blue Sky Potential is a kind of best-case scenarios—those situations where market conditions and company performance exceed expectations. Essentially, it captures the gains a stock could achieve under favorable conditions.

For instance, the same $10,000 investment might grow to $18,000 in the best 2.5% of scenarios. This figure motivates investors who are open to taking on greater risk in pursuit of higher rewards. Balancing these two perspectives is critical: while the Risk Floor keeps your expectations grounded, the Blue Sky Potential encourages optimism and ambition. Together, they help investors frame their strategies more effectively.

Comparing and Contrasting Perspectives

The Risk Floor and Blue Sky Potential represent opposite ends of the risk-reward spectrum:

- Risk Floor Focus: Prioritizes capital preservation and minimizing losses. It appeals to conservative investors who value stability.

- Blue Sky Potential Focus: Prioritizes maximizing gains. It resonates with risk-tolerant investors seeking high growth.

Let’s compare two investments:

- SPY (S&P 500 ETF): A diversified fund with a relatively stable Risk Floor and moderate Blue Sky Potential, reflecting its lower volatility.

- TSLA (Tesla, Inc.): A high-growth stock with a lower (more severe) Risk Floor but a significantly higher Blue Sky Potential, reflecting its higher volatility.

Diversification matters. While SPY offers stability, TSLA provides high-risk, high-reward opportunities. By blending these types of investments, you can capture growth while managing downside risks.

Emotions matter, too. Fear of losses can lead to overly conservative strategies, and greed can drive overly aggressive approaches. Viewing both the Risk Floor and Blue Sky Potential in tandem helps mitigate these emotional extremes.

Starting up the Monte Carlo Simulation Engine

We simulated SPY’s price over one year using 1,000 possible paths derived from historical data. The resulting plot shows price developments scattered across a spectrum, with the Risk Floor highlighted in red and the Blue Sky Potential in blue.

Next, we ran the same simulation for TSLA using its historical data as inputs.

Overlaying the two simulations reveals clear differences: SPY’s simulations (in green) and TSLA’s (in orange) illustrate that SPY has a higher (less negative) Risk Floor, while TSLA’s Blue Sky Potential is significantly higher. As expected, SPY is less volatile and thus safer, while TSLA offers higher growth potential but comes with greater risk.

Note: While entire books have been written about Monte Carlo simulations in finance, our goal is to simplify these concepts for every beginner investor. Experts often overcomplicate them, but we focus on what truly matters: the red “Risk Floor” for understanding downside risk and the blue “Blue Sky Potential” for identifying growth opportunities.

Your Personal Monte Carlo Simulation Tool

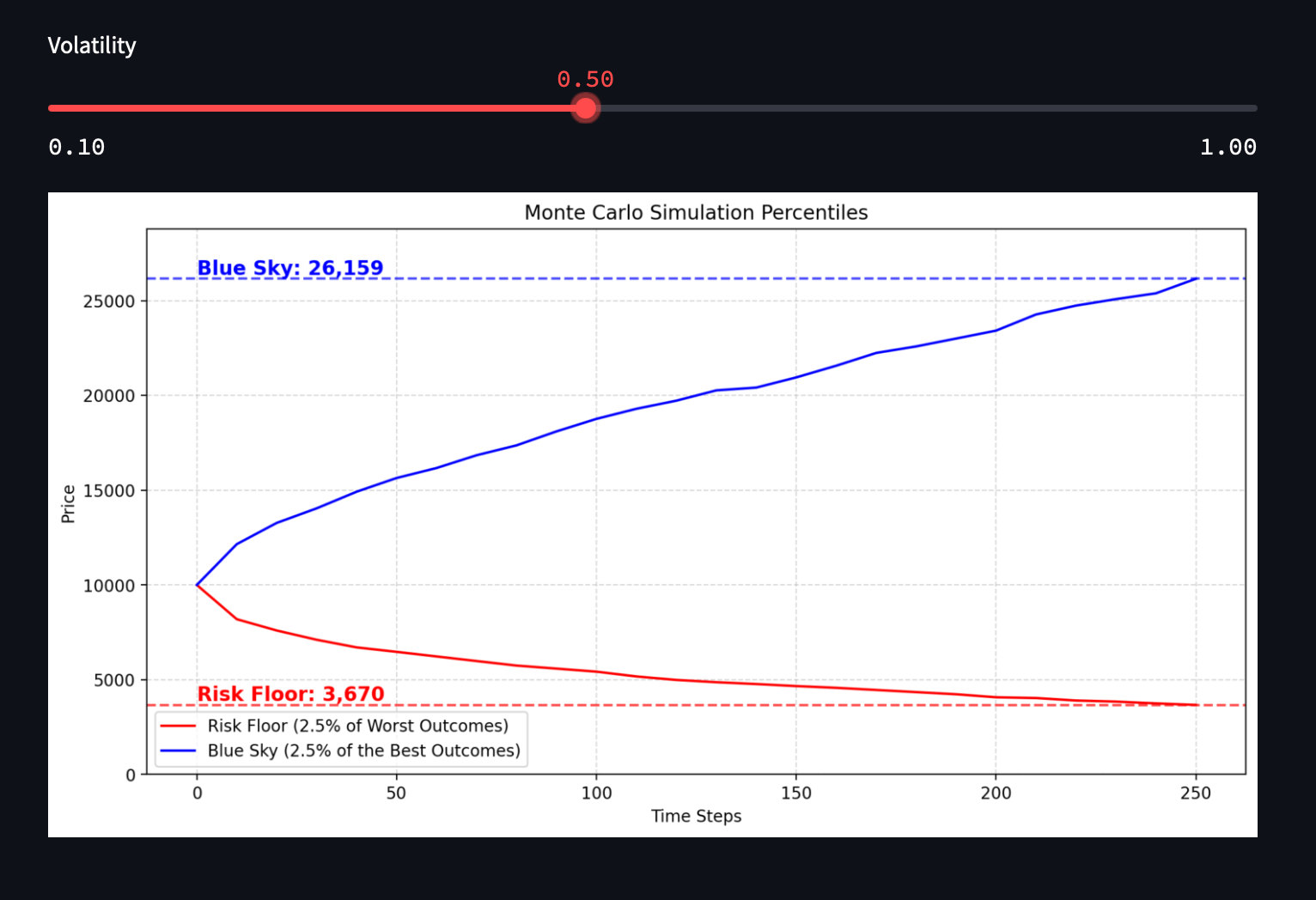

We’ve created a new tool where you can input different volatility values and see both the Risk Floor and Blue Sky Potential. You can explore the tool here.

It simulates the potential outcomes of a $10,000 investment over one year, based on the volatility you select. By adjusting the volatility slider, you can discover the point at which the potential downside risk becomes unacceptable to you.

What is your personal volatility limit?

Bringing it All Together

The Risk Floor and Blue Sky Potential are two sides of the same coin. Together, they define the boundaries of what investors can realistically expect, providing a comprehensive view of both risk and opportunity.

Investing is about balancing dreams and fears. By understanding the full spectrum of possible outcomes, investors can plan effectively, make informed decisions, and invest with greater confidence. As you evaluate your portfolio, ask yourself: does your strategy protect against the downside while still allowing you to reach for the upside?

Keeping both the Risk Floor and Blue Sky Potential in mind helps you create an investment plan that is both resilient and ambitious—giving you the best chance of achieving your financial goals.

PS: If you are lucky and have long floppy ears - just let them fly in the wind and live in the Blue Sky Potential every day!