25,000 Money Making Machines?

How many ETFs are there? 25,000 globally? How can you get an overview? Let's get to work!

It's time to take a closer look into all the Exchange Traded Funds (ETFs) out there and understand what choices we have. Think of the ETFs as money making machines. Yes, there are money making machines out there!! You didn't know? Now you do! 😀

There are almost 4,000 money making machines (ETFs) listed in the US alone and almost 21,000 globally. So we are talking about a very long list of 25,000 ETFs. How the hell do you choose where to send your money to work? Reading 25,000 advertisements? That will not happen!

We need to reduce that number to a more sensible shorter list. Wouldn't you agree?

First! Let's focus on the US market, because most of the non-US ETFs are very similar in terms of risk and return. If you are using an international broker, chances are high that you have access to the US listed ETFs.

In one of the upcoming posts we will discuss why US brokers might give you an advantage. Sneak preview: Most US brokers are members of SIPC, protecting customer accounts up to $500,000, including $250,000 in cash, in case of broker insolvency. This protection applies to all customers, regardless of nationality. However, SIPC doesn’t cover market losses from poor investments. Some brokers, like Interactive Brokers, offer additional excess SIPC insurance with coverage up to $30 million.

Most local non-US brokers and local banks will give you access to the US-listed ETFs anyway or have their own equivalent.

Ok. Good! Now we are dealing only with around 4,000 US ETFs - actually only 3,890 ETFs to be precise. Great! 😅

I will use TradingView for this analysis since they get their data from institutional-grade providers, including ICE Data Services and FactSet.

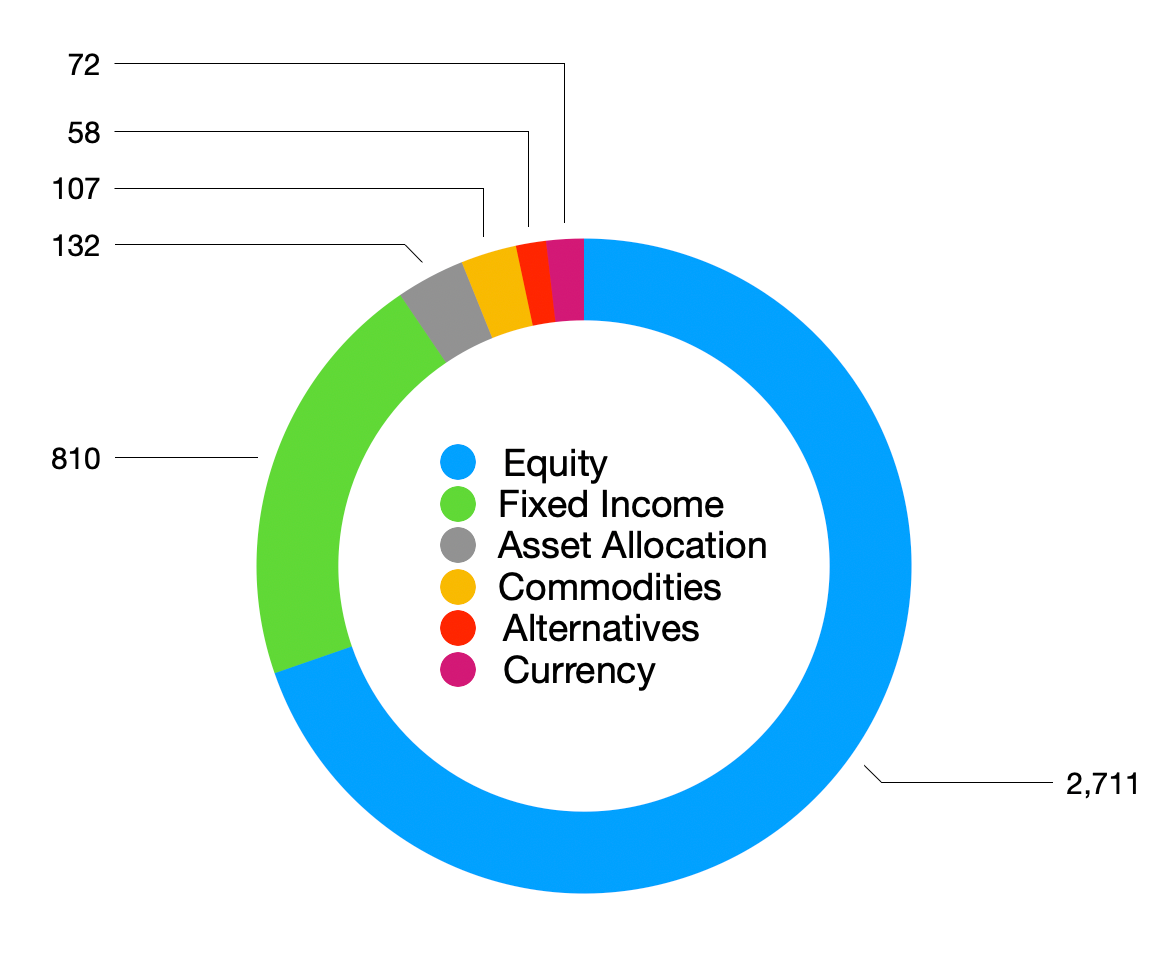

By categorizing all 3,890 ETFs, we gain an initial understanding of the different investment options available.

Equity ETFs

2,711 ETFs are Equity ETFs like the SPY we already know. These ETFs provide exposure to stocks or shares of companies, either by tracking a broad market index like the S&P 500 (SPY) or focusing on specific sectors or regions.

Fixed Income ETFs

810 ETFs are Fixed Income ETFs. These ETFs invest in bonds or other debt instruments, offering typically more stable returns and lower risk. They are used by investors looking for income generation or portfolio diversification with less volatility than equities.

Asset Allocation ETFs

123 ETFs are so called Asset Allocation ETFs. These ETFs combine different asset classes, such as stocks, bonds, and sometimes commodities, to create a more balanced investment approach.

Commodities ETFs

107 ETFs are Commodities ETFs. These ETFs track the performance of commodities like gold, oil, or agriculture. They can help investors diversify their portfolios by gaining exposure to physical assets. They often have a low correlation with traditional equities.

Alternative ETFs

58 ETFs are so called Alternative ETFs. These ETFs invest in alternative assets or strategies, such as real estate, private equity, or 'hedge fund like' strategies. They are used to add diversification and can potentially hedge against market volatility.

Currency ETFs

72 ETFs are Currency ETFs. Currency ETFs track the performance of a particular currency or a basket of currencies. They allow investors to gain exposure to foreign exchange markets without directly buying foreign exchange currencies. They are often used for hedging or speculative purposes. They can also provide diversification.

Wow! Ok. We now have a better overview for sure. But how did all of this start?

Maple Syrup and ETFs? 🇨🇦

Did the Canadians invent ETFs? Yes, it began in 1990 in Canada with the launch of the Toronto Index Participation Shares (TIPS), which tracked the Toronto Stock Exchange 35 Index.

The first U.S. ETF was introduced in 1993 with the launch of the SPDR S&P 500 ETF (SPY), which became the most widely recognized ETF and tracks the S&P 500 index. ETFs were created to combine the benefit of diversification with the ability to buy and sell throughout the day. Over time, the ETF market expanded drastically.

Today's ETF market is much more advanced than years ago. Two examples to demonstrate this: In 2021 Simplify Asset Management created a new ETF called SVOL which trades a short volatility strategy previously only done by hedge funds. With this ETF you can buy a small piece of a hedge fund strategy. Earlier this year Deutsche Bank created a thematic ETF called XAIX to focus on Artificial Intelligence and Big Data. We will explain both of these in a future post.

Hold on! I see some of you falling asleep - and I hear you say "Yes, Bla Bla Bla ... show me the money!"

Ok ok! 😉 I stop teaching!

Let's check which money making machine produced the most amount of new money since the beginning of 2024. Are you ready?

The Top 5 Money Making Machines

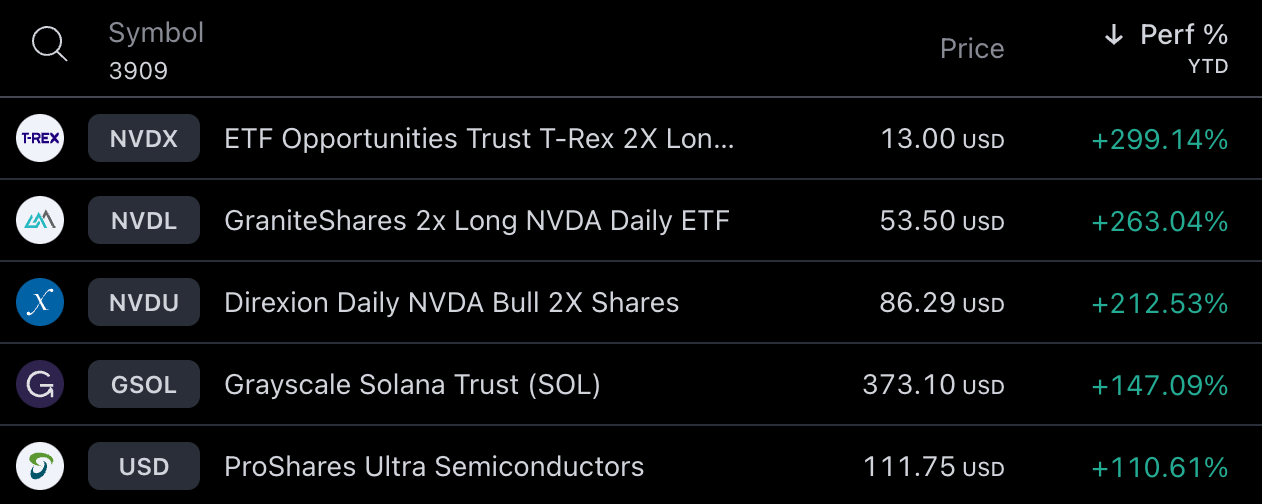

May I present you the top 5 money making machines year to date:

What the heck, is this real? Yes it is! Let's look into it.

Leveraged Single Stock ETFs

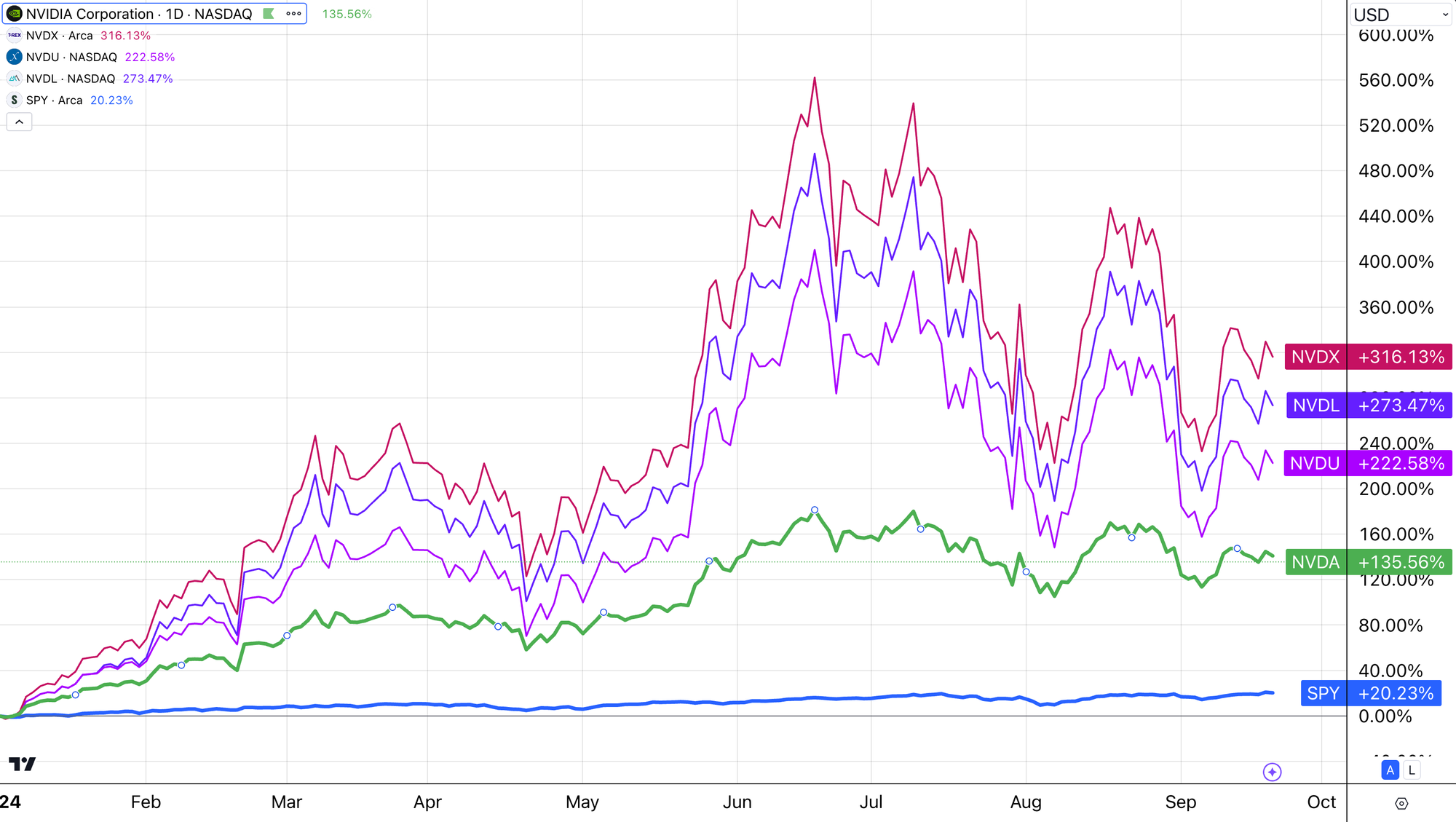

The top three ETFs on our money making machine list are so called single stock leveraged ETFs which in this case invested in NVIDA, but with leverage. As you can see in the chart below NVDIA had a YTD return of 135%. What do these leveraged ETFs (NVDX,NVDL and NVDU) do different? What is leverage actually?

Let's look at NVDX. You can download the prospectus here. The prospectus is a detailed, legal document that ETF issuers must file with the SEC (Securities and Exchange Commission). It provides key information about the ETF, such as its investment strategy, risks, fees, and financial details. By law, all ETFs must file this to ensure transparency and protect investors by offering clear insights into how the fund operates.

AI Tip: Download the prospectus, upload it to ChatGPT and ask for a simple English summary and ask questions.

When you invest money into NVDX, the ETF managers use that capital as collateral for derivatives, specifically total return swaps. These swaps are agreements with counterparties, such as large financial institutions, that allow the ETF to replicate twice the daily performance of NVIDIA. This means for every 1% move in NVIDIA, the fund seeks to deliver a 2% return (or loss), effectively doubling the daily risk and reward for the invested money. This leverage strategy can significantly amplify both gains and losses, making it a high-risk, high-reward “rocket booster”.

Crypto ETFs

On position 4 is a crypto ETF called GSOL. You can download the prospectus is here. GSOL gives investors exposure to Solana, a leading blockchain platform.

Rather than holding Solana tokens directly, investors can buy shares in GSOL, which represent a stake in the underlying Solana assets held by the ETF. This allows investors to participate in the price movements of Solana without having to manage wallets, exchanges, security concerns related to direct cryptocurrency ownership, etc.

If all of this crypto talk doesn't make much sense to you, don't worry we will get into this later. Buying Crypto ETFs like Grayscale’s Solana Trust (GSOL) provides an extra layer of safety compared to other methods of crypto investing. Since all ETFs like GSOL must be registered with the SEC, they operate under stricter regulatory oversight, reducing the risk of fraud. Unlike holding cryptocurrency directly in a wallet, these financial products are managed by professional institutions, with assets held by qualified custodians. These funds are audited and subject to financial reporting requirements, giving investors more security and transparency.

Leverage Index ETFs

Let's look at number 5 on our money making machine list - USD ETF. You can download the prospectus here.

USD provides 2x the daily performance of the Dow Jones U.S. Semiconductors Index. It uses leverage similar to the NVDX ETF described above but applied to semiconductor index, aiming to double the returns of the index on a daily basis. This ETF is primarily used by short-term traders looking to amplify their exposure to the semiconductor sector. Due to the daily resetting of leverage, it is not intended for long-term holding, as compounding can lead to performance deviations over extended periods.

Do you want to see the worst performing ETFs year to date? No? 😳 Are you serious? 🧐 Ok. You will get away with this today, but in the next few weeks we will dive deeper into each ETF category. Let's not just look at returns, but also at the risk and the associated Sharpe ratios. If you don't remember, have a look at our previous Volatility post!

Conclusion

There are a lot of ETFs to choose from! Just looking at the top 5 best performing ETFs, it is clear that statements like "ETFs are safe and boring", is far from the truth. There are many "booster rockets" out there and we need to understand their mechanics (ie propulsion systems) and know when to ignite them.

Dana our creative python and machine learning scientist is always ready to discover the ETF mysteries out there.

I can hear you "Is there a leveraged SPY ETF out there?", "What happens when we apply the Moving Average Strategy to a leveraged SPY ETF or any other ETF?" Great questions! We will get there!